Investors hungrily acquired share offerings of Canadian gas and oil companies within the first three months of the year, however the record-setting quarter hardly signals rising appetite for that troubled sector in the capital markets.

'Fragile five': These OPEC producers take presctiption the verge of collapse if oil prices don't stabilize

‘You will find five sovereign producers which are around the precipice of the major crisis amid the current low oil price environment,’ RBC Capital Markets said inside a report. Read on

‘You will find five sovereign producers which are around the precipice of the major crisis amid the current low oil price environment,’ RBC Capital Markets said inside a report. Read on

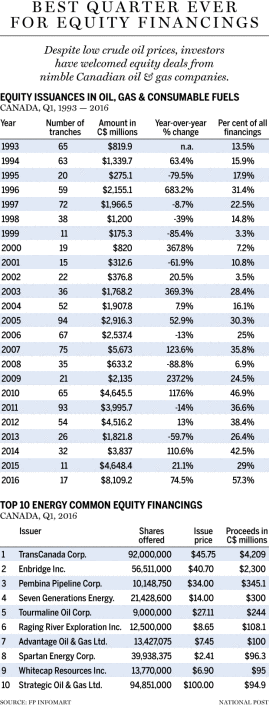

As many as 16 oil and gas equity financing deals raised a lot more than $8 billion within the first 3 months of 2016 – the sector’s best ever quarterly record since at least 1993, based on FP Infomart data.

The offerings nearly doubled the $4.6 billion raised through 11 transactions a year earlier. Indeed, the equity issued this season is near to the $8.6 billion raised all this past year.

But the numbers mask the matter that merely a select number of dividend-paying infrastructure companies, or top-tier firms with strong growth opportunities and stellar management teams, could entice public markets.

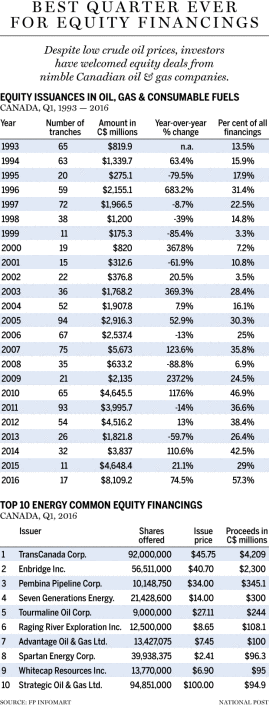

Midstream players less influenced by volatile oil prices for example TransCanada Corp., Enbridge Inc. and Pembina Pipeline Corp. taken into account 85 percent of the equity raised.

People discuss an archive quarter within the energy space, however for those three deals, it might have been a very tepid quarter for energy deals

TransCanada closed a $4.4-billion share sale Friday to finance a portion of its proposed transformative purchase of Columbia Pipeline Group Inc. Pembina intends to make use of the $345 million it raised to acquire gas assets.

“People discuss a record quarter within the energy space, however for those three deals, it would have been a really tepid quarter for energy deals,” said Ross Bentley, partner at Blake, Cassels & Graydon LLP, who had been involved in the TransCanada and Pembina offerings.

“It’s an indication that the market has the capacity to do large deals for quality issuers,” Calgary-based Bentley added. “If you decide to go beyond that in traditional exploration and production companies, it is a a lot more mixed message there.”

U.S. crude prices rose 4.3 per cent throughout the quarter, erasing a deep slump within the first month of the season, to reach US$39.7 per barrel, lifting share prices of even the weaker companies.

But the S&P/TSX Capped Energy index rose 6.62 percent in the first quarter, handily beating the U.S. S&P 500 Energy Sector Index’s 3.11 per cent begin the period.

The surge encouraged a few of the more stable companies to tap markets and reduce their debt pile.

Related

Saudi Arabia plans $2-trillion mother of all wealth funds to wean kingdom off oil’Fragile five’: These OPEC producers are on the verge of collapse if oil prices don’t stabilize soonBank of Canada warns economy’s recovery from oil shock will require more than two yearsCanada’s recovery at risk in ‘twilight zone’ of low oil and rising loonie

“The stars have aligned – and equity window has opened within the last four or five weeks,” said John Mercury, Calgary-based head of non-public equity at law practice Bennet Jones LLP. “The equity markets were tight or closed for some time period, so it made a backlog of demand.”

The equity deals are dilutive for existing shareholders, but they don’t appear to mind, perhaps hoping that the transactions position the companies well for an upturn in oil prices. Indeed, the majority of the companies have been rewarded with a share-price surge above their recent issue price.

There is increased concentrate on repairing balance sheets in the producer community, especially since the Canadian oil and gas sector lost $230 billion in market cap from June 2014 to February 2016, based on S&P Capital IQ data.

Debt-to-cash-flow ratios above four times are usually viewed as reason to be concerned among Canadian oil and gas companies.

Stubbornly low oil prices have left a lot of companies overlevered and under pressure from senior lenders and other creditors to address the problem.

“Naturally, there is pressure to pay down debt,” Mercury said.

Seven Generations Ltd., which raised $300 million in February, said hello will use the funds to lessen its indebtedness. Energy investment broker Peters & Co. estimates Seven Generations’ debt-to-cash-flow ratio will decline to two.7 by 2017, one of the lowest ratios in its coverage universe.

Raging River Exploration Inc., which raised $108.1 million in March, said the web proceeds will initially be “used to repay some of outstanding indebtedness.”

And Advantage Oil & Gas Ltd. will use the $100 million it raised to cut its debt, but also channel some of the proceeds to some planned expansion of its Glacier gas plant.

But the financial markets are not open for those, and lots of within the oil patch are scrambling to either sell assets or shut down production.

Cutting capex and dividend commitments doesn’t change the industry’s leverage profile, that has risen to all-time highs, noted Kyle Preston, a National Bank Financial analyst.

“The only option that companies need to improve their leverage profile is to sell assets (difficult market with limited buyers), issue equity (available only to selective companies), refinance debt (minimal impact) or watch for commodity prices to recuperate,” Preston said inside a note to clients on Thursday.

As many as 150 companies in the exploration and production and services sector require financing, but investor appetite remains lacklustre, leaving many with limited options.

The lack of public-market interest has forced a minimum of three public companies to run into the arms of private-equity firms.

“We think you will see more of those,” Mercury said. “We also have clients which are thinking about IPOs at this time within the energy service space too. We are planning for late 2017, maybe 2018.”

For now, markets remain cautious towards exploration and production financing, Bentley said. “When we could possibly get to a commodity price at or over US$50 we might see a rise in market activity,” he said.

yhussain@nationalpost.com

twitter.com/YAD_FPEnergy

‘You will find five sovereign producers which are around the precipice of the major crisis amid the current low oil price environment,’ RBC Capital Markets said inside a report. Read on

‘You will find five sovereign producers which are around the precipice of the major crisis amid the current low oil price environment,’ RBC Capital Markets said inside a report. Read on Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news