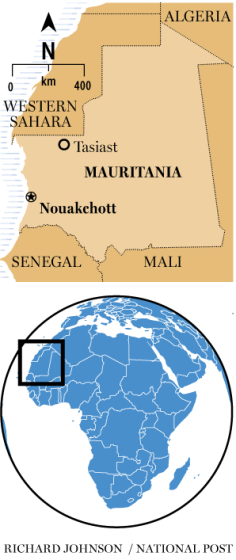

TORONTO ? After more than 4 years of not so good news and uncertainty, Kinross Gold Corp. finally has a workable development arrange for its long-troubled Tasiast mine.

The Toronto-based miner greenlighted the first phase of the two-step expansion plan at Tasiast on Wednesday. Kinross invested US$300 million in the first phase, which is expected to boost production in the Mauritanian mine by 87 percent to 409,000 ounces annually. The company expects this move will finally result in the money-losing mine profitable.

“What’s ideal for use is for US$300 million of capital, we basically double the production and drop the operating costs significantly. It truly creates a great mine that anyone would want to own,” chief executive Paul Rollinson said within an interview.

Until recently, lots of investors wondered if the mine would ever be salvaged.

Tasiast was controversial for Kinross from the start. The organization acquired the property this year, when it paid a mind-boggling US$7.1 billion for Red Back Mining Inc. That deal is widely viewed as one of the most overpriced within the good reputation for the gold mining industry.

Related

Kinross study results should be ‘constructive step forward’ for TasiastKinross Gold Corp to battle shut-down of Chilean mine, says this didn’t cause low water level

Before long, the West African project was plagued by soaring costs. Kinross wound up recording multiple writedowns on Tasiast that destroyed the majority of its carrying value. Former CEO Tye Burt was fired in 2012, in part because of ongoing problems at the project.

Before long, the West African project was plagued by soaring costs. Kinross wound up recording multiple writedowns on Tasiast that destroyed the majority of its carrying value. Former CEO Tye Burt was fired in 2012, in part because of ongoing problems at the project.

Rollinson was named as his replacement, and one of his first serves as CEO ended up being to downsize the business’s development plans at Tasiast in order to to reduce costs and risk. Under his watch, Kinross released a feasibility study in 2014 that envisioned a US$1.6-billion purchase of Tasiast. But gold prices were low and the return wasn’t attractive, therefore the plan was shelved.

Kinross returned to the drafting board. It decided to study a potential two-stage method of expanding the mine that may reduce costs further. On Wednesday, the company released economic studies from that plan. They suggest that Tasiast, finally, might be a viable gold mine.

After spending US$300 million to boost production to 409,000 ounces a year within the first phase, the 2nd phase envisions a further investment of US$620 million to boost annual output to 777,000 ounces. Kinross expects to make a decision on phase two by the end of the coming year.

On paper, the phased approach looks much better than the single-stage approach. The projected construction costs are much lower (US$920 million versus US$1.6 billion) and operating cost is lower as well. However, gold production is roughly eight percent reduced the phased plan as fewer tonnes of ore are processed per day.

Rollinson noted that with a phased approach, there is less engineering work, less equipment and a smaller construction camp. He also said Kinross will not require a US$300-million seawater pipeline, that was a costly area of the single-step plan.

He hopes this development plan will ultimately take away the black cloud that has hung over Kinross for years. Uncertainty about Tasiast is a huge continue the company’s stock price, but which should begin to fade since there’s some clarity on its future.

“There’s a lot of gold in the earth over there, and I think we’ve got a really safe and sensible way forward to change this asset,” Rollinson said.

pkoven@nationalpost.com

Twitter.com/peterkoven

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news

Before long, the West African project was plagued by soaring costs. Kinross wound up recording multiple writedowns on Tasiast that destroyed the majority of its carrying value. Former CEO Tye Burt was fired in 2012, in part because of ongoing problems at the project.

Before long, the West African project was plagued by soaring costs. Kinross wound up recording multiple writedowns on Tasiast that destroyed the majority of its carrying value. Former CEO Tye Burt was fired in 2012, in part because of ongoing problems at the project.