OTTAWA – The Liberal government revealed Tuesday that it will ‘t be fulfilling its election promise to reduce the little business tax rate, proposing that the rate should remain unchanged at 10.5 per cent for the foreseeable future.

The original platform required the speed to become brought down in tranches to nine percent by 2019. It had been already lowered from 11 percent to 10.5 per cent in January of this year.

Because the other three changes already are legislated for 2017, 2018 and 2019, the Liberals will need to introduce new legislation to keep the speed frozen.

“It’s a big broken promise in the authorities,” said Dan Kelly, head from the Canadian Federation of Independent Business, in an interview. “I have to admit I did not check this out coming.”

The CFIB estimated that Canadian businesses might have saved some $900 million annually because of the cuts. Kelly said that keeping the speed at 10.5 percent, plus a proposed extension of Employment Insurance benefits, implies that costs will rise for the country’s small businesses within the future years.

Related

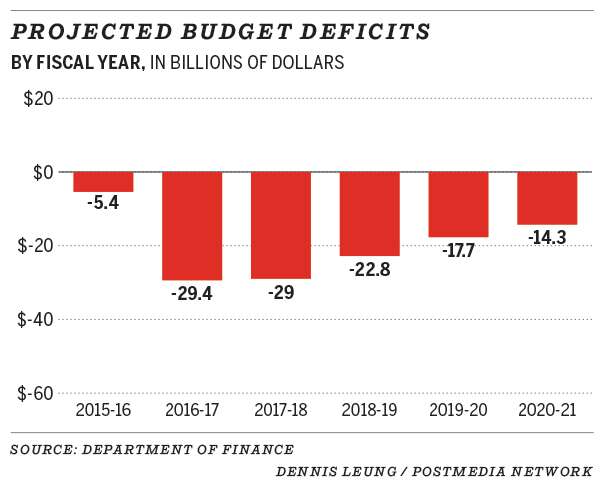

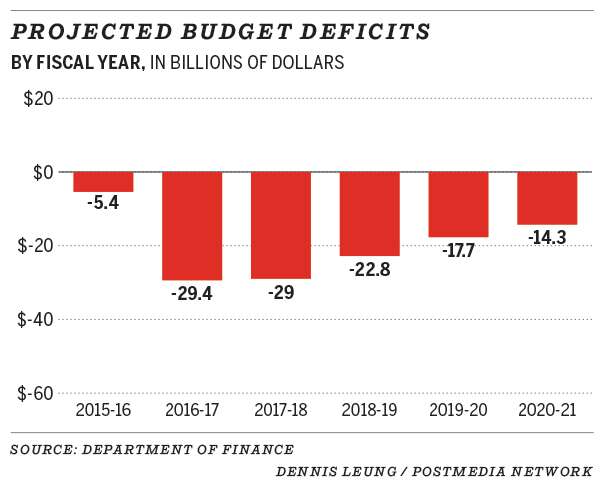

Liberals project $30B deficit and do not plan a return to surplus by 2019Liberals to invest $11.9-billion on infrastructure over two yearsOttawa to spend as much as $3.4B in public transit to deal with 'lost productivity,' but falls short of Via Rail demands

He also voiced concern the lack of relief comes at a time when the country’s economy is constantly on the see damage from the crash in oil prices, that the Bank of Canada noted earlier this year has impacted spending confidence among energy and non-energy companies.

“It really sends the message that small firms have dropped from the high priority to a non-issue,” Kelly said. “There is absolutely nothing in this budget, save for some infrastructure spending, that will help just one small business produce a single job any place in the country.”

The Liberal government did proceed by having an election promise to shut a loophole within the small company deduction, which wealthy individuals exploited like a tax shelter. A new proposal says that Canadian-controlled private corporations will no longer have the ability to claim another small business deduction of $500,000 high is a partnership of businesses not associated with one another.

But, the Liberals are earmarking money for a new “Innovation Agenda” that the government says will help make Canada’s companies more innovative and competitive in the global economy.

“Our objective of growing the economy is fundamental to us and our innovation agenda is crucial to that particular,” said Finance Minister Bill Morneau throughout a press conference Tuesday. “We’re setting ourselves up for any longer-term innovation strategy.”

This includes a Post-Secondary Institutions Strategic Investment Fund that will provide up to $2 billion over 3 years. The brand new fund will support a number of investments, including expansion of incubators and accelerators at colleges and universities and converting under-utilized space into new information labs.

Also in the budget is $800 million earmarked to aid innovation networks and to promote the development of “clusters,” over four years. The federal government noted it desired to begin to see the kind of knowledge sharing that gave rise to Silicon Valley and Canada’s high-tech cluster in Kitchener-Waterloo, Ont.

An additional $95 million per year will be presented to analyze granting councils on an ongoing basis, with the Liberals highlighting it was the “highest quantity of new annual funding for discovery research in more than a decade.”

The Liberals will also be introducing a new High Impact Firm Initiative, that is set to supply consulting and advice to high-growth, innovative firms. Other organizations, such as the Business Development Bank of Canada, have identified so-called high impact firms as companies that tend to benefit the economy most.

“(The program is) designed to help firms scale up and additional their global competitiveness through co-ordinated services tailored to meet for their needs,” the government said in the budget.

The initiative aims to target 1,000 firms in first couple of years and expand to more firms thereafter.

Financial Post

jshmuel@nationalpost.com

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news