OTTAWA – Mario Draghi is not the type of central banker to back away from the fight, and Thursday wasn’t any different.

Faced with low inflation over the eurozone, the ecu Central Bank president – who once famously pledged to do “whatever it takes” to shore up the economy from the 19-nation economy and steer clear of a deflation spiral – is cranking up his efforts.

This time, Draghi announced the ECB is cutting its key rates of interest and upping the ante on quantitative easing through expanded bond buying as the eurozone finds itself uncomfortably backed against a wall and facing stagnation.

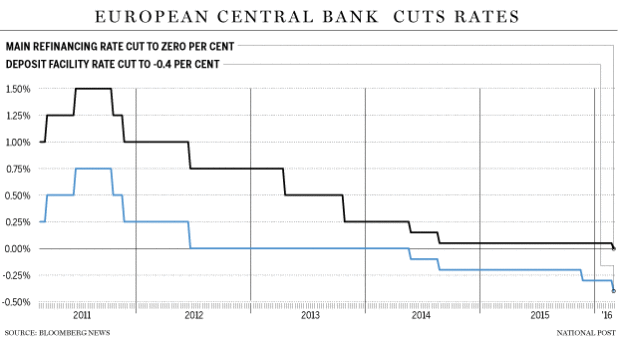

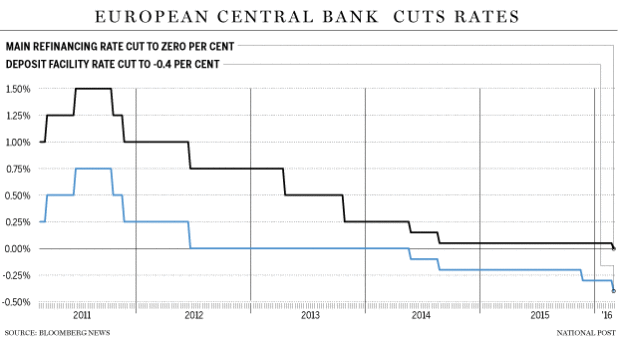

The ECB first recorded negative rates in 2014, and it has since been accompanied by other major central banks, including Japan, Switzerland and Sweden.

On sleep issues of the Atlantic, the U.S. Fed have turned the monetary corner – thanks to steady economic and jobs growth that are now enabling borrowing costs to get back on an upward trajectory.

Related

ECB's Mario Draghi fires the largest bazooka yet – and markets are loving itBank of Canada holds key interest rate as it waits on Ottawa’s fiscal boost

In December, the Fed increased its key rate to some range between 0.25 and 0.5 per cent – the first rise in almost Ten years.

With the Fed raising rates and also the ECB cutting them, the financial institution of Canada finds itself in the middle of the policy ladder – holding interest rates steady and waiting for promised federal stimulus to kick in this year to assist lift output and increase employment rolls.

“Canada being stuck in the centre probably makes us the envy of a large amount of central banks (by) having a much more optimal policy mix,” said economist Charles St-Arnaud at Nomura Global Economics working in london.

Other central banks “would love to have fiscal (policy) to be able to play a role and also have less of the heavy-lifting to be done” on their own, he said.

“The ECB did a lot (Thursday). But I’m sure if there was some willingness to use fiscal room to assist, they would feel much better.”

The new efforts by Draghi and his ECB governing council – coming twelve months after launching a preliminary round of QE – will see monthly asset purchases rise to 80 billion euros (US$90 billion) from 60 billion euros.

Overnight rates for banks parking their cash at the ECB will fall to 10 basis suggests negative 0.4 percent, increasing pressure around the financial sector to invest their cash to assist create jobs and growth, instead of having cash sitting idle at the ECB.

The ECB also cut its main lending rate to zero from 0.5 percent.

“It’s a fairly long list of measures, and every one of these is very significant and devised to have the maximum impact in boosting the economy and also the go back to price stability – we’ve shown we are not short of ammunition,” Draghi told reporters in Frankfurt.

“From today’s perspective, we do not anticipate it will be essential to reduce rates further.”

St-Arnaud, at Nomura, said the brand new moves announced by Draghi will provide “a very pro-growth package,” and addresses “how to try to get around everything and make the cash actually reach the real economy.”

“In a means, they need to do more since the fiscal (side) cannot contribute, or is not willing to contribute, depending on politics.”

The ECB announcement came only hours following the New Zealand central bank on Thursday cut its key lending level by 25 basis points to a record-low 2.25 per cent, citing weak domestic inflation and concern over slower growth in China.

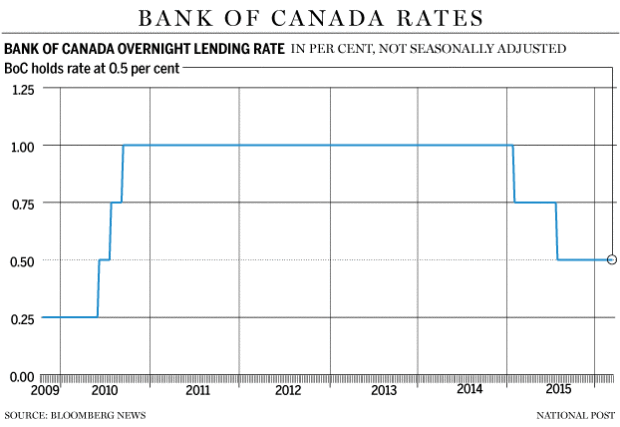

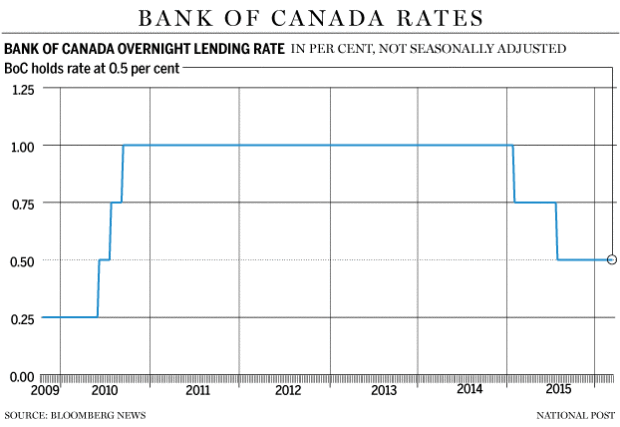

On Wednesday, the financial institution of Canada decided to stand pat on its trendsetting rate of interest, now at 0.5 per cent, and await the details of the new Liberal government’s 2016-17 budget, looking for March 22.

Governor Stephen Poloz and the policy team reduced their key lending level twice in 2015 after the energy sector was hit through the global crash of oil prices, which pushed the nation into recession within the first 1 / 2 of the year.

“I aren’t seeing them following the Fed path (higher) any time soon,” said Emanuella Enenajor, senior economist at Bank of America Merrill Lynch in Ny.

“Given what’s happening in housing in Canada – a housing market that continues to defy gravity – that’s a consideration on their behalf because they look at downside risks towards the economy and whether or not this makes sense to ease, particularly with the us government stepping in,” Enenajor said.

“So, you’d actually need a big negative shock, I believe, to justify any more easing from the Bank of Canada.”

The upcoming federal spending blueprint is designed to help repair a number of last year’s economic damage, but it will even push Canada right into a budget deficit in excess of $10 billion -with more money going for infrastructure projects and new tax breaks for middle-class Canadians.

More central bank decision are coming next week – the financial institution of Japan , followed by the Fed on Wednesday and also the Bank of England on Thursday.

Financial Post

gisfeld@nationalpost.com

Twitter.com/gisfeld

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news