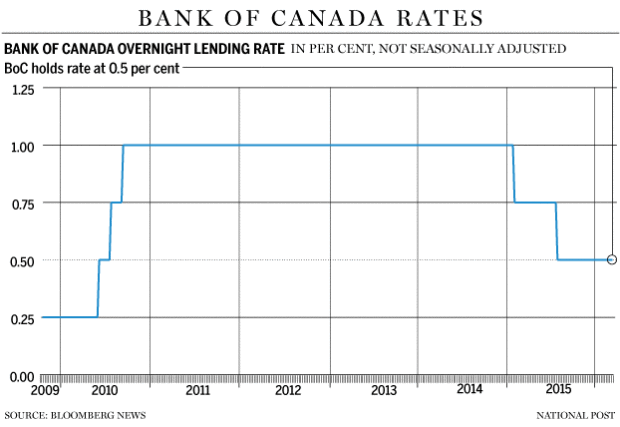

The Bank of Canada said Wednesday that some of the pressures facing the country’s economy have eased this season as it left its benchmark interest rate unchanged Wednesday.

Bank of Canada holds key rate of interest because it waits on Ottawa’s fiscal boost

The central bank takes a wait-and-see approach to the brand new federal government’s plans for multi-billion-dollar spending. Continue reading

The central bank takes a wait-and-see approach to the brand new federal government’s plans for multi-billion-dollar spending. Continue reading

The relatively optimistic outlook carries on exactly the same tone put down in January. In those days, optimism would be a more surprising avenue, as global markets were in the midst of a steep correction and concerns were being raised about growing risks of a world recession.

But Canada’s economy isn’t out of the woods just yet. Below, the Financial Post has compiled what analysts are saying concerning the bank’s latest rate announcement.

Announcement casts doubt on rate cuts this year

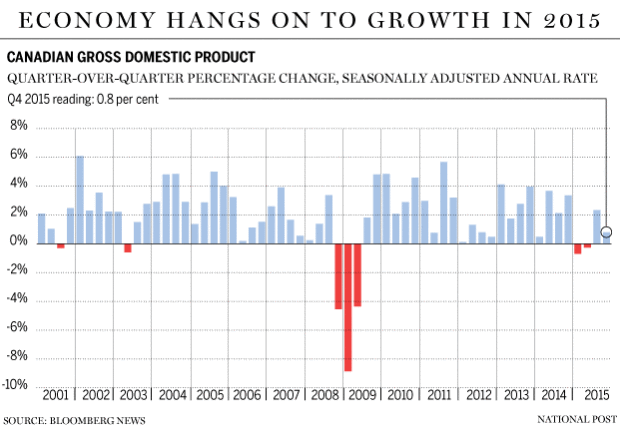

The market has steadily priced the likelihood of an additional BoC rate cut over the past seven weeks, and analysts are even more doubtful on further moves. The combination of firmer oil prices, much-improved non-resource exports, and also the dawning realization that, yes, the Fed actually will raise rates this year have all contributed to the modification in sentiment. We would ‘t be so quick to rule out the financial institution of Canada completely: GDP growth continues to be well below potential (at best it’ll rise 1-1/2% this season), unemployment is grinding higher (up 0.6 ppts in the past year), and the currency’s bounce has removed it being an obstacle to rate cuts. Fiscal stimulus from Ottawa is no miracle growth cure for the economy, and then any relapse in oil prices only will expose the actual soggy growth outlook. The scalding housing market in some cities will be a valid reason for the BoC to stay put, but they seem to have washed their collective hands on that front (“last type of defence”). Overall, while this Statement doesn’t shut the doorway on another cut, it does absolutely nothing to advance the reason. Doug Porter, chief economist, BMO Capital Markets

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news