HOUSTON ? Brian Ferguson was one of the oil executives in a global energy conference here listening intently now to Saudi oil minister Ali Al-Naimi’s warning to high-cost producers to exit the trade. But he remains unmoved.

Good news, oilsands growth is unstoppable. Unhealthy news, it’s unstoppable

Claudia Cattaneo: Canada will keep churning out more oil, a minimum of until 2020, but it’s just that long-term horizon that could be our undoing inside a volatile future

Read more

“Part of what (OPEC is) trying to do is create uncertainty about price, so longer-lead projects would be very hard,” the CEO of Calgary-based Cenovus Energy Inc. said in an interview around the sidelines of the IHS CERA event that attracted a couple of,800 energy industry executives and government officials, in addition to a strong contingent from Canada.

While U.S. shale producers attract much of OPEC’s ire, the Saudi oil minister also named the Canadian oilsands the type of who had prospered in the past decade as OPEC “subsidized” them, however it will now let free markets take over.

The OPEC-orchestrated free-for-all has sent oil prices reeling to some decade-low, leaving thousands in Calgary, Houston and elsewhere unemployed, with expected capital spending in the oilsands set to contract to $16 billion this year from $28 billion in 2014, according to Peters & Co.

“A very real and troubling impact of low oil prices includes reduced employment inside our companies and through the logistics, including transportation, manufacturing and high tech,” said Steve Williams, CEO of Suncor Energy Inc. inside a speech in the Houston event.

There is really a strong sense in the industry that this is really a structural, perplexing downturn.

Related

Canada’s oil industry faces rising threat from its own backyard, IEA warnsCut costs, borrow cash or liquidate: Saudis deliver harsh message to other oil producers

“Few people can tell you what is happening in oil markets, but I will try,” said an exasperated OPEC Secretary-General Abdalla Salem El-Badri, because he blamed just-in-time U.S. shale output for that market glut.

Canadian oil companies have little time for OPEC’s machinations.

“I can’t make my financial commitment on which OPEC may or may not do,” said Ferguson.

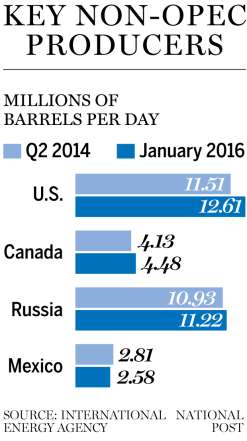

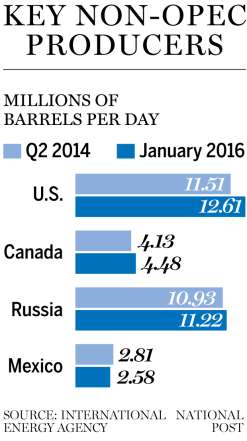

Cenvous plans to raise production by 100,000 barrels per day this year, area of the 800,000 bpd of Canadian oil likely to enter the market during the next 5 years, International Energy Agency estimates.

But Suncor’s Williams said the will have to “rethink” the way it operates and take advantage of the oilsands unique attributes.

“We are almost not part of the oil industry- just because a lot of the characteristics in our business are extremely different,” William said. “We have vast amounts of resource easily available and our clients are not just one of exploration, development and production. It’s largely capital investment- and very efficient manufacturing.”

Canadian producers will also be facing a unique domestic crisis, as not one other major oil-producing country on the planet has such a schizophrenic relationship with its resources.

Despite being home to the biggest coastline on the planet to its east and west, Canada includes a solitary, choked-full 300,000-barrels-per-day Trans Mountain pipeline to gain access to markets other than america. Plans for brand new conduits have been delayed, denied and disparaged as global warming issues involves the fore.

The newly elected Liberal government considers moving natural resources to markets a “national goal,” but Natural Resources Minister Jim Carr is careful not to cheer-lead the sector, instead focusing on putting in place a strong process that garners public confidence.

“Everybody knows that there needs to be regulatory reform to ensure that major projects to become approved,” Carr said within an interview in Houston.

The industry doesn’t appear to be waiting for either OPEC or the Canadian government. Cenovus spend less by 30 per cent this past year and expects more reductions this year, because it aims to lower your turnaround time for large-scale projects and rein in steam-to-oil ratios.

Companies are also aiming to reduce their carbon emissions to ensure they continue to be within Alberta’s new 100-metric-tonne-per-year cap, without sacrificing growth.

“If you think the emissions cap is going to get in the way of future growth, you are either incredibly bullish on prices or incredibly bearish on technology, and I would say we want the opposite of this to achieve success,” said Andrew Leach, who spearheaded the climate change review panel set up through the NDP government in Alberta.

For its new projects, Suncor is planning to design an agenda once and replicate it 10 times to create economic savings that spend less up to 50 per cent and soften its impact on the environment.

“My feeling is technology will make a genuine impact on the environmental impact and the cost base,” Williams said. “I see those things over the following four or five years appear in certain scale.”

yhussain@nationalpost.com

twitter.com/YAD_FPEnergy

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news