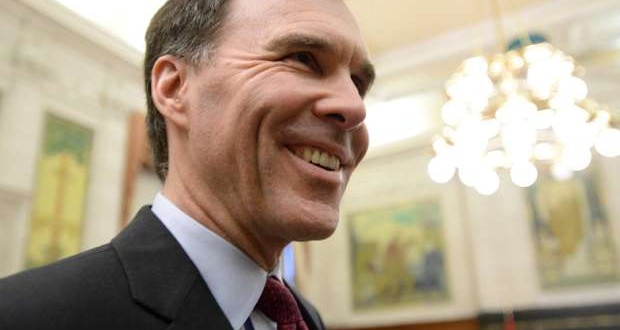

OTTAWA – Finance Minister Bill Morneau will use this week’s meeting of commercial nations to promote Canada’s economic blueprint as a possible path for improving growth and financial stability in other states.

Morneau will join his G20 counterparts on the global stage throughout a two-day summit beginning Friday in Shanghai – a conference which comes in a critical here we are at economies now facing renewed threats to growth and financial stability.

While there is general agreement among the G20 that the world is facing a major challenge to reverse a slowdown among the richest economies, there’s less common ground on which to complete about this.

As head from the G20 this season, host China intends to push for movement on overall economic structural reforms and infrastructure investment, as well as encourage more focus on reforming financial regulations and improving oversight on international tax regimes.

Related

Bank of Canada deputy governor raises red flag on rising household debt, but says product is ‘resilient”Flashing warning signs’: Canadian markets bracing for ‘dramatic’ Bank of Canada action – and a recessionBank of Canada keeps rates on hold, awaiting wild card from Trudeau’s stimulus plans

But issues surrounding monetary and fiscal policies are likely to hold the spotlight – plus a slowdown in China’s own economy and domestic market volatility, along with the outlook for oil prices and their impact on global growth.

Canada’s finance minister is expected to create towards the table the requirement for actions like the new Liberal government’s intends to pump billions of dollars into this country’s economy – targeted on infrastructure spending and tax breaks for middle-class families – to advertise long-term growth.

“I is going to be proud to reconfirm Canada’s approach to economic growth as I use my fellow G20 finance ministers to strengthen the worldwide economy and help create prosperity for all of our citizens, particularly the middle-class and also the most vulnerable people in our societies,” Morneau said inside a statement.

“Our government believes that smart investments throughout the economy, including investments in research and innovation, produce the conditions necessary for a good standard of living, a safe and secure retirement, and prospects for future generations.”

Morneau will push the Liberal intend to target tax breaks for that middle-class, support for additional needy Canadians and investments in infrastructure – all of which the government says will ensure the benefits of a long-term growth strategy are spread over the economy, a senior Finance official said in a background briefing for reporters on Thursday.

That could be a try to sell you for some of Canada’s G20 partners.

“Negative rates of interest are proving insufficient to get back to full employment globally, and fiscal policy will be a more powerful tool,” said Avery Shenfeld, chief economist at CIBC World Markets.

“But it’s hard to see the eurozone backing fiscal stimulus and larger deficits in their region, given Germany’s political bent, and Japan seems dedicated to higher sales taxes,” he added. “China has room to ramp up deficits and cut rates of interest further and will also be encouraged through the G20 to do this.”

The International Monetary Fund has already highlighted the gulf between what is accomplished and what might be achieved by the G20.

With the collapse in global oil prices, any proceed to help restructure weaker economies might be compromised by disappointing growth in leading countries, including in Canada where the plunge in crude has pushed Alberta and Newfoundland and Labrador into recession, and may now perform the same nationally – just months after a mini-recession in the first half of 2015.

In a study released Wednesday, the IMF said the G20 “must plan now for co-ordinated demand support using available fiscal space to boost public investment.”

For Canada’s Liberals, elected inside a federal vote in October, the continuing deterioration from the global economy, with few signs of a sustained rebound in oil prices, has forced the federal government to drastically revise its deficit outlook with this fiscal year – now likely to be more than $18 billion, while many economists express it could reach $30 billion.

The final tally is going to be contained in Morneau’s 2016-17 budget, to be sold March 22.

“There is definitely an increasing view around the world that government should be considering stimulating growth a little more around the fiscal side,” said Emanuella Enenajor, senior economist at Bank of America Merrill Lynch in Ny.

“The fact that Canada is actively doing that, or is dedicated to doing that, I believe makes a large amount of sense given the fiscal room that the government has,” she said.

“I think Canada is in a unique position among the G20 so that you can do this. Of course, we have to recognize that government spending is merely a Band-Aid solution. Greater spending by Ottawa will temporarily support growth. It cannot be trusted to be a sustainable growth driver, and it will need an ending point.”

gisfeld@nationalpost.com

Twitter.com.gisfeld

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news