A spirited oil rally barely extended to some fourth consecutive day on Thursday, as Iran seemed to be cool to some Saudi-Russia proposal to freeze output.

Saudi Arabia and Russia agree to freeze oil output, but deal ‘not worth much’ without Iran, Iraq

Saudi Arabia and Russia, the earth’s two largest crude producers, agreed to freeze output after talks in Qatar.

Continue reading.

Crude oil prices have rallied more than 14 percent since Saudi Arabia, Russia – two of the world’s largest oil producers – together with Venezuela, Iraq and Qatar, unveiled intends to maintain their production to levels reported in January, provided other major OPEC and non-OPEC producers joined in. On Thursday, U.S. crude managed to eke out an increase of just US11 cents to US$30.77 per barrel, climbing down from from its peak of US$31.98, after the producers’ meeting in Tehran yielded no alternation in supply outlook and traders fretted over rising U.S. inventories.

But Citibank analysts were built with a succinct warning concerning the rally: Oil bulls are “clutching at straws,” i was told that.

“The market clearly wants to see some indications of life in OPEC, but we think bulls (or rather producers fearful of further price falls) are likely to be better served” by concentrating on the summer outlook for gasoline, Citibank analyst Seth Kleinman said inside a note Thursday.

Iran’s buy-in is vital for a meaningful pact because the country is poised to create between 500,000 to 1 million barrels per day of oil towards the market in the next 12 months after global powers lifted sanctions around the country captured.

Market speculation was that Iran would be offered a cap of 300,000 bpd above its current levels.

“That it was insufficient speaks with the idea to Iran’s confidence that it may exceed time this season, or to the breakdown in inter-OPEC relations, or both,” Kleinman said.

Iran argues OPEC members such as Saudi Arabia and Iraq exceeded their quota to make up for Iran’s sanction-induced production decline in the last four years, plus they ought to be the ones rolling to make way for Iran.

“If there’s a will between Saudi Arabia and Russia to control the market, it (the freeze) will happen,” says Sara Vakhshouri, a Washington-based analyst who once worked for the nation’s Iranian Oil Company. “But if they are waiting for Iran, it’s not a rational decision.”

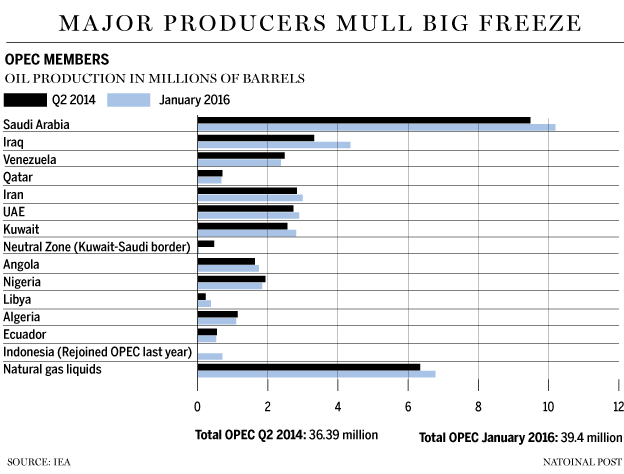

The Big Freeze pact between major producers is within itself a half-hearted attempt to manage markets, as the five countries have collectively raised their production by nearly 2 million bpd because the second quarter of 2014, data in the International Energy Agency shows.

The pact would have little effect on prices as the countries are freezing, not cutting, output, said Omar Al-Ubaydli, a Bahrain-based analyst.

“All the Saudis do is showing the planet, and their internal constituents, that the world cannot be trusted and, affirmed, Iran didn’t waste whenever,” said Al-Ubaydli, a senior affiliated research fellow with the Arlington-based George Mason University.

A few months from now, search for Russian President Vladimir Putin to claim he can’t control Russian oil firms as they are private companies.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news