Royal Dutch Shell Plc said hello depleted its gas and oil reserves much faster than it replenished all of them with new resources in 2015, its worst performance since an accounting scandal that engulfed the organization 12 years back.

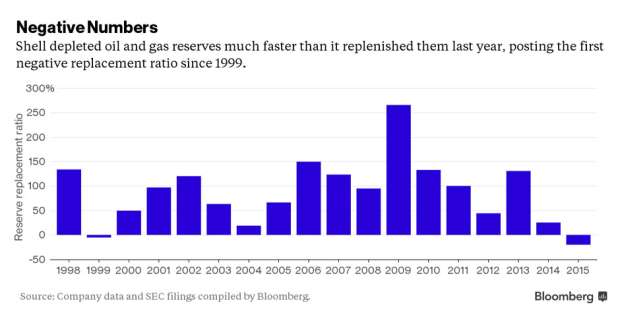

Shell said its reserves replacement ratio – the proportion of oil and gas production in the past year that was offset by the addition of new resources – was minus 20 percent. The organization not just failed to replace the 1.1 billion barrels equivalent it pumped in 2015, but additionally wrote off another 200 million barrels to take into account the plunge in oil prices.

Oil and gas reserves are crucial for valuing companies simply because they form the grounds for future output. While producers aim to replace a minimum of 100 per cent of the reserves they pump each year, a sudden drop in oil prices can mean some resources held on their own books are no longer economic to create. Shell’s last negative replacement ratio was in 1999 – an amount that was only revealed in 2004 when the company slashed total reserves by 20 per cent after admitting it had overstated them for quite some time.

“It’s not normal, obviously,” Chief Financial Officer Simon Henry told reporters on a conference call following the company’s fourth-quarter results.

Project Cancellation

Shell blamed the drop last year on low crude prices and the cancellation of its 80,000 barrel-a-day Carmon Creek oil sands project in Canada. “We significantly curtailed spending by reducing the number of new investment decisions and designing lower-cost development solutions,” Chief Executive Officer Ben Van Beurden said inside a statement.

Other major oil companies fared far better within the same price environment. BP Plc reported Feb. 2 a reserve replacement ratio of 61 percent for 2015, while Chevron Corp. achieved 107 per cent. Shell’s ratio was “weak,” said Oswald Clint, an analyst at Sanford C. Bernstein & Co.

Shell asserted its total oil and gas reserves at the end of 2015 stood at 11.7 billion barrels equivalent of oil, down 1.4 billion barrels in the previous year. The company reported a 44 per cent drop in fourth-quarter profit and is betting its $50 billion acquisition of BG Group Plc, set to close on Feb. 15, can help it maintain dividends and increase gas and oil production at any given time when income is shrinking.

Shell admitted more than a decade ago it have been overestimating how big its gas and oil resources by almost a quarter, particularly in Nigeria. The company restated reserves for that period from 1997 to 2002, making further changes in 2003 and 2004. The ensuing scandal led to fines in the U.S. and U.K., hundred of huge amount of money of payments to settle investor lawsuits, the ouster from the company’s chairman, and also the consolidation of the Dutch and British branches of the corporation.

The scandal resulted in closer scrutiny of how oil companies book their gas and oil reserves by auditors, regulators and investors.

Bloomberg.com

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news