OTTAWA – Rates of interest shouldn’t be the only real tool to promote financial stability, said the financial institution of Canada’s Timothy Lane, amid worries of highly indebted consumers and frothy housing markets in Toronto and Vancouver.

Lane, deputy governor from the Bank of Canada, designed a speech in Montreal Monday concentrating on monetary policy’s effects on financial stability. The financial institution of Canada has been loosening policy in the past year as Canada handles an adverse terms-of-trade shock because of the collapse in oil prices.

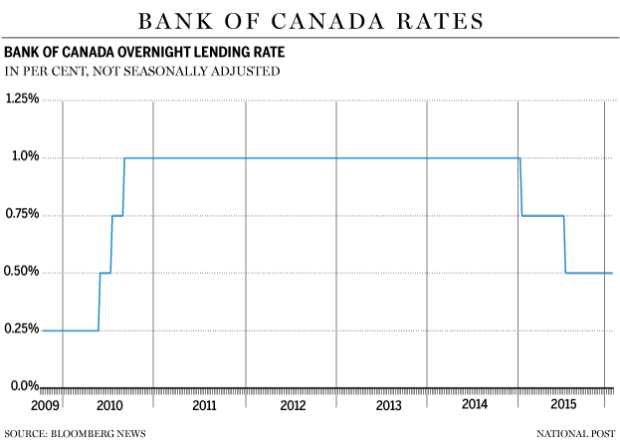

Lane asserted when the Bank of Canada had not cut rates of interest last year – by 25 basis points in January and by another 25 basis points in July, bringing the overnight lending rate to its current 0.5 percent – it could have worsened the Canadian economy and caused a crisis. Avoiding that outweighed creating a further imbalance in household debt and some housing markets in Canada, he explained.

Instead, Lane asserted those imbalances could be offset with further aid from fiscal policy.

“In a situation of sustained weak aggregate demand, relying mainly on monetary policy to supply stimulus may lead to financial vulnerabilities that macroprudential policy cannot, or should not, offset,” he explained. “In such circumstances, fiscal policy might be called upon to provide stimulus, particularly as it is apt to be more efficient at low interest.”

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news