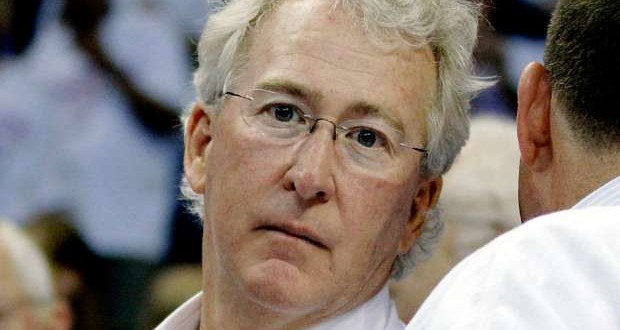

HOUSTON – Aubrey McClendon was the face from the nation’s natural gas boom, a swashbuckling innovator who pioneered a shale revolution.

Former Chesapeake CEO Aubrey McClendon dies in car crash next day of being indicted

McClendon was charged with conspiring to rig bids to purchase oil and gas leases in Oklahoma, as well as on Wednesday his car crashed into a wall and burst into flames.

Continue reading.

He built a fortune as head of Chesapeake Energy, whose embrace of new production techniques unlocked previously untapped deposits and helped wean the United States from ever-increasing dependence on imports.

But late Tuesday, he was indicted on federal bid-rigging charges accusing him of conspiring to suppress prices for oil and gas leases. And on Wednesday morning, he died in a crash in Oklahoma City after his car hit a bridge at high-speed. McClendon, 56, ended up being to have appeared in court later within the day.

“He was charismatic along with a true American entrepreneur,” said T. Boone Pickens, popular oilman himself, who knew McClendon for 25 years. “No individual is without flaws, but his effect on American energy is going to be long-lasting.”

Even in business noted for bigger-than-life executives, McClendon was a mythical character. His interests went far beyond the oilpatch, including part ownerships of the Oklahoma City Thunder professional basketball team along with a winery in Bordeaux, France. He bragged about his $12 million antique map collection.

In his years at Chesapeake, that they co-founded in 1989, it might end up being the second-biggest natural gas producer in the United States. Only Exxon Mobil produces more.

But his spectacular rise was accompanied by a similarly stunning fall with his ouster in 2013.

And his indictment now cast a dark shadow over his career. It was with the Justice Department late Tuesday, accusing McClendon of orchestrating a conspiracy by which two unidentified companies colluded not to bid against each other for the purchase of several gas and oil leases in northwest Oklahoma between late 2007 and early 2012.

Under McClendon’s leadership, Chesapeake would be a darling of Wall Street because he acquired leases across the nation and liberally employed hydraulic fracturing to unlock huge amounts of natural gas in Texas, Oklahoma, Ohio and Pennsylvania.

Related

The lavish and leveraged lifetime of Aubrey McClendonChesapeake CEO McClendon to resign after board finds no improper conductEncana and Chesapeake slapped with lawsuit for allegedly rigging land sales

But Chesapeake and a number of others released a lot gas that they glutted the marketplace. Natural gas prices collapsed, pulling on the value of Chesapeake’s shares during the last 5 years.

The company’s problems were compounded by revelations that McClendon had taken an individual stake in Chesapeake wells after which used those investments as collateral for approximately $1.1 billion in loans, used mostly to pay his share from the cost of drilling those wells.

Those revelations ignited a revolt by Chesapeake’s board, and that he was forced to leave the organization three years ago.

When McClendon began quietly acquiring leases around 2005, most energy analysts thought america faced a future of gas shortages. Billions of dollars were invested in import terminals that would receive liquefied natural gas from Qatar and other gas-producing countries. But McClendon’s explorations were so successful there wasn’t any longer any need for imports, and the terminals quickly became virtually unusable.

He was charismatic along with a true American entrepreneur

Now, in a once-unthinkable turnabout, some are being converted to export liquefied gas.

McClendon’s corporate pursuits reflected his eclectic interests. As the company grew from the origins in 1989, he developed a corporate campus in Oklahoma City that looked a lot more like an Ivy League school than a bit of the oilpatch, having a cafeteria that served international fare and a gymnasium outfitted just like a spa.

McClendon dabbled in politics and personally appeared in television commercials promoting the advantages of gas as an alternative of coal burning for power. He unsuccessfully pushed for natural gas-fuelled cars.

Aubrey Kerr McClendon, the son of Joe and Carole Kerr McClendon, was created July 14, 1959, in Oklahoma City right into a family steeped in the oil industry. His father was a petroleum products salesman. Aubrey McClendon’s lineage also included Oklahoma notables, included in this Robert S. Kerr, an old Oklahoma governor and senator and an oilman himself.

Classmates at Duke University remembered McClendon, who studied history, for his expansive appetite with as well as for having copies of Businessweek magazine strewn round his room. He graduated almost 30 years ago having a bachelor of arts ever.

It was at college that he met his future financier, Ralph Eads III, a good investment banker with Jefferies. McClendon married his college girlfriend, Kathleen Upton Byrns. Along with his wife, he’s survived by two sons, Will and Jack; a daughter, Callie; and a grandchild.

As an entrepreneur, he had an identity for aggressive practices.

He was once fined US$250,000 through the Basketball for bragging that he and the partners didn’t buy the Seattle SuperSonics to help keep the team in Seattle – a statement that was at odds using the NBA commissioner’s intentions. The Sonics gone to live in Oklahoma City anyway – a much smaller market – for the 2008-09 season. They play in Chesapeake Energy Arena.

While the indictment did not identify the two companies, most energy experts believe they are Chesapeake and SandRidge Energy, also based in Oklahoma City and formerly led with a onetime partner of McClendon. The 2 companies previously disclosed in regulatory documents that they are being investigated through the Justice Department’s Antitrust Division.

SandRidge had yet to comment on the indictment, while Chesapeake said it was cooperating using the investigation and didn’t expect to face criminal penalties.

According towards the Antitrust Division, the businesses secretly decided who would win leases, and the winning bidder allotted an interest in the leases to another company. The indictment said that McClendon instructed his subordinates to conspire with others in the second company to allocate leases among themselves.

“His actions put company profits in front of the interests of leaseholders entitled to competitive bids for gas and oil rights on their own land,” said William J. Baer, assistant attorney general in the Antitrust Division. “Executives who abuse their positions as leaders of major corporations to arrange criminal activity must be held accountable for their actions.”

The indictment on Tuesday was filed in the U.S. District Court for that Western District of Oklahoma. The Justice Department said it was the very first case resulting from a federal antitrust investigation into price-fixing, bid-rigging along with other anti-competitive conduct in the oil and natural gas industry.

At first, McClendon and the lawyers expressed indignant disagreement with the indictment, although McClendon didn’t expressly deny there have been discussions having a competitor.

He was always searching for worlds to overcome. And he did that.

“The charge that has been filed against me today is wrong and unprecedented,” McClendon said in statement released Tuesday night. “I have been designated because the only part of the oil and gas industry in over 110 years because the Sherman Act became law to possess been accused of this crime in relation to joint bidding on leasehold.”

Under the federal Sherman antitrust statute, violations have a maximum penalty of 10 years in prison along with a $1 million fine.

The indictment followed a four-year federal investigation that began after Reuters revealed in 2012 that Chesapeake had discussed with EnCana, an adversary Canadian energy giant, how to suppress land lease prices in Michigan. Last year, Chesapeake settled by receiving pay $25 million as compensation to landowners with leases.

While the police did not characterize the death as a suicide, Capt. Paco Balderrama from the Oklahoma City police asserted McClendon drove “via a grassy area before colliding in to the embankment.” He added, “There was plenty of chance of him to fix and get back on the roadway, and that didn’t occur.” McClendon was not wearing a seat belt.

The state medical examiner’s office will determine the reason for death, the police said.

After his ouster from Chesapeake in 2013, McClendon quickly turned his attention to his next venture, co-founding American Energy Partners, a private oil company. His goal ended up being to take the fracking revolution worldwide.

“He was always looking for worlds to overcome,” said Melvin Moran, an Oklahoma oil executive who knew McClendon for years. “And that he did that.”

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news