The Liberal government will announce new environmental assessment rules Wednesday afternoon for energy projects C like the Energy East and Trans Mountain pipelines C that are currently being reviewed through the National Energy Board. Natural Resources Minister Jim Carr confirmed the timing of the announcement for the “transition” process for pipelines under review through the NEB. Carr and Environment Minister ...

Read More »Author Archives: privatefinancetips

Russian companies back talks with OPEC on possible cuts to oil output

MOSCOW – The head of Russian state oil pipeline monopoly Transneft says talks on output cuts are planned with Saudi Arabia and OPEC. Transneft head Nikolai Tokarev asserted Saudi Arabia had “taken the initiative and come by helping cover their a proposal to go over the potential of reducing volumes,” in comments reported by Russian news agency RIA Novosti. Related ...

Read More »With founder Dov Charney out of the picture, American Apparel looks ahead

American Apparel executives and board members regained a stride of control now: A personal bankruptcy court judge approved their plan to move forward with a reorganization strategy that transfers ownership of the company from shareholders to lenders, and in doing so, strips founder Dov Charney of any stake from the company. Charney continues to be aggressively fighting to return to ...

Read More »‘Wall of cash’ said to await Canadian energy sector after forgettable year for deals

It was the type of year when chief financial officers had to search hard and use every tool at their disposal to fortify their companies’ balance sheets. With crude oil shedding 45 per cent of their value in 2015, Canadian oil and gas producers glumly took an axe to their costs. “The industry adopted a very pragmatic and very nimble ...

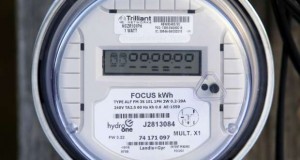

Read More »Hydro One’s ‘showcase’ IPO offered investors a slice of stability in uncertain times

Launching an IPO seems risky in a downturn, however the Ontario government’s decision to list 15 percent of electrical utility Hydro One was embraced through the market like a stock that offered a slice of stability in uncertain times. Despite retaining 85 per cent from the company, the Ontario government pledged to punch below its investment weight and let the ...

Read More »Canadian capital markets expect P3 financing windfall from Ottawa’s stimulus spending

As the us government prepares to invest vast amounts of dollars on infrastructure projects to help stimulate the floundering economy, Canadian capital markets are expecting a corresponding bonanza in financing opportunities for public-private partnerships. During the election, the Liberals dedicated to spending $125 billion on infrastructure during the next decade. It’s assumed that the large part of those funds goes ...

Read More »‘Asymmetrical economics’ in WPT Industrial REIT deal leave some disappointed

What were they thinking? All we know would be that the decisions made by WPT Industrial REIT following an eight-month strategic review – which failed to look for a buyer for the entire company – have disappointed investors plus some property analysts. How much so? The units, which traded within the US$11 range in the week prior to the decision’s ...

Read More »CIBC analysts reduce bank growth forecasts as oil, economy drag

Low oil prices and recurring economic malaise are going to weigh on bank earnings more than expected, causing analysts at Canadian Imperial Bank of Commerce to reduce profit estimates. “We have bent our earnings estimates lower through our forecast period, having a more pronounced impact later in the year and into (fiscal) 2017,” the analysts, led by Rob Sedran, wrote ...

Read More » Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news