OTTAWA – The us government has confirmed plans to provide $251.4 million to Alberta within program designed to help provinces hit by sudden revenue downturns. Alberta has been sideswiped by collapsing oil prices and also the little-known fiscal stabilization program provides help when provincial revenues fall by a lot more than five percent from one year to another. Money in ...

Read More »Author Archives: privatefinancetips

Finance Minister Bill Morneau defends bigger deficits, sticking to Liberals’ stimulus script

OTTAWA – As debut performances go, Finance Minister Bill Morneau managed to stick close to the Liberal script on the requirement for deficit-fuelled stimulus spending, and avoided any major policy pratfalls, in his first appearance before Canadian lawmakers. Bill Morneau names Dominic Barton, head of McKinsey & Co., to government’s economic advisory council Dominic Barton, the brand new head from ...

Read More »London Stock Exchange is in merger talks with German rival Deutsche Boerse

London Stock Exchange Group PLC is in merger talks with Deutsche Boerse AG, a tie-up that will create one of the greatest exchange companies on the planet. 'If the TSE went dark, would it really matter?': Exactly what the future holds for Canada’s stock exchanges Depressed commodities and the oil collapse have crimped the S&P/TSX composite’s performance – prompting questions ...

Read More »Sears Canada exits more store leases, handing off 8 Sears Home leases to Leon’s Furniture

TORONTO – Sears Canada Inc. will hand eight of its big-box Sears Home store leases to Leon’s Furniture Inc., a potentially disappointing sign to have an historically robust section of its business. Tuesday’s announcement, which provides coverage for four home stores in British Columbia, three in Ontario and one in Moncton, N.B., may be the latest inside a series of ...

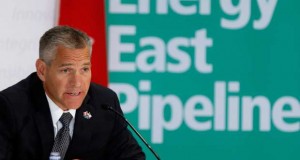

Read More »When ‘social licence’ costs become unbearable

Social licences have become the premise of Justin Trudeau’s thought-provoking policy about energy-project developments. They have also be a main reason why western provinces and the business community have started to doubt the best minister’s leadership and the willingness to stand for a healthy energy sector. To begin with, nobody exactly understands (and never will) exactly what a social licence ...

Read More »Hudson’s Bay Co reveals solid sales bump as online sales surge 23%

TORONTO – In a possible bid to quell investor concern with the impact of the unusually warm winter on apparel retailers, Hudson’s Bay Co. revealed partial fourth-quarter and full-year sales results Tuesday that showed a solid improvement, should you strip the effects of currency. The Toronto-based operator of Hudson’s Bay, Lord & Taylor and Saks Fifth Avenue reported sales at ...

Read More »Royal Bank of Canada, Sun Life Financial Inc grow cautious on commercial loans as slumping economy raises risk of default

Canada’s largest commercial-mortgage lenders, including Sun Life Financial Inc. and Royal Bank of Canada, are turning more cautious as the commodities slump stunts economic growth and enhances the chance of default. “We’re concerned about the stage in the real-estate cycle Canada’s in at this time – there’s more risk in the market,” Michael Andrews, md of Toronto-based Sun Life’s Canadian ...

Read More »Purpose-built residential rental market picking up steam in Canada, new report suggests

As pension funds and other big investors seek new, reliable income streams, purpose-build rental is at levels not seen in two decades. ‘White-hot’ Vancouver, Toronto housing markets could be dragged down by rest of Canada, report says A new report from Moody’s Analytics says Canada’s two priciest markets may ultimately be dragged down by housing results in all of those ...

Read More » Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news