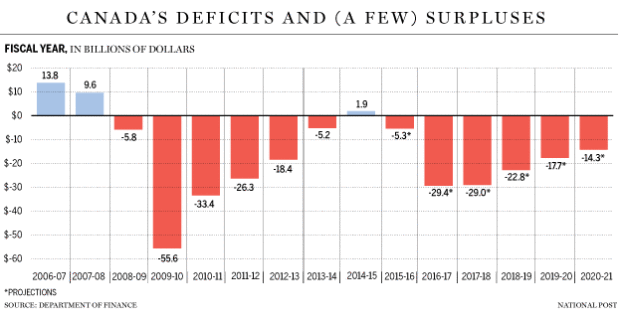

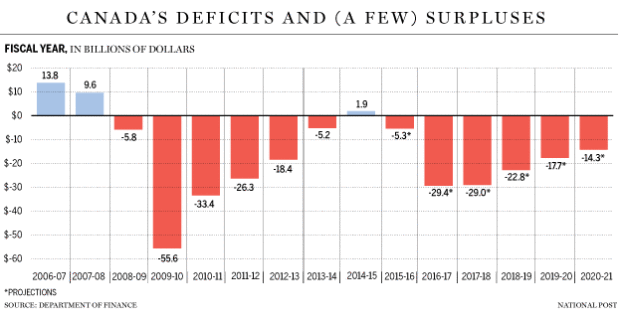

OTTAWA – The Trudeau government has confirmed what a lot of private-sector analysts have predicted for months: Canada is headed for a string of near-record deficits as it plows many billions of dollars into new programs – many of them promised, a few not – along with multi-year infrastructure projects that have yet to be decided.

After eking out a $1.9-bilion surplus in the previous fiscal year during the final months under the Conservatives, the Liberal Party will return the country to shortfalls, beginning this year with a $5.4-billion hole in 2015-16 and growing to a lot more than $29 billion within the next fiscal year.

In delivering Tuesday’s federal budget, Finance Minister Bill Morneau told Parliament the Liberals’ first spending document targets “revitalizing the economy within the years and decades to come, in order that it works for the center class and helps those working hard to become listed on it.”

But the Liberal’s long-awaited blueprint lacked detail on how so when it will lift the country from its deficit hole.

Erasing that red ink will even take longer than Prime Minister Justin Trudeau anticipated in the months before and following his party’s Oct. 19 win over the Conservatives, then led by Stephen Harper.

In his ever-first budget, Morneau has set the economy on target for at least five years of deficits – up until fiscal 2020-21- by launching a stimulus plan that will initially provide regulations to middle-class Canadians in addition to build and replace crumbling infrastructure.

“I would actually make the situation right across their fiscal forecast that the starting point probably isn’t as dire as they played it out,” said Douglas Porter, chief economist at BMO Capital Markets.

“What I’m concerned about is that they’ll basically use any surprises towards the best to increase spending in the years ahead,” Porter said. “And I suspect the best deficit numbers probably will are available in pretty close to these numbers, or a tiny bit better.”

Related

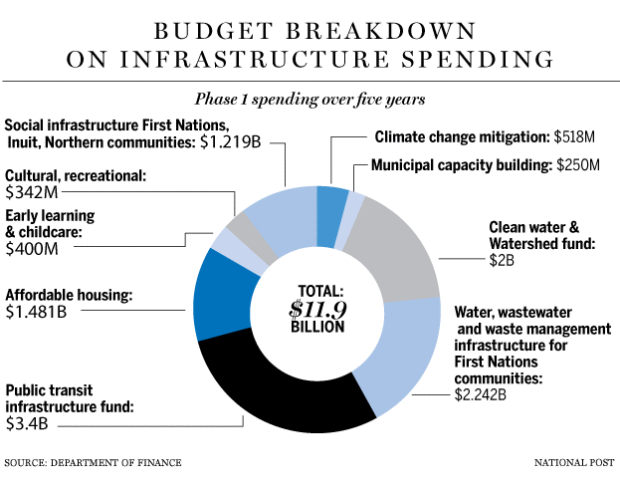

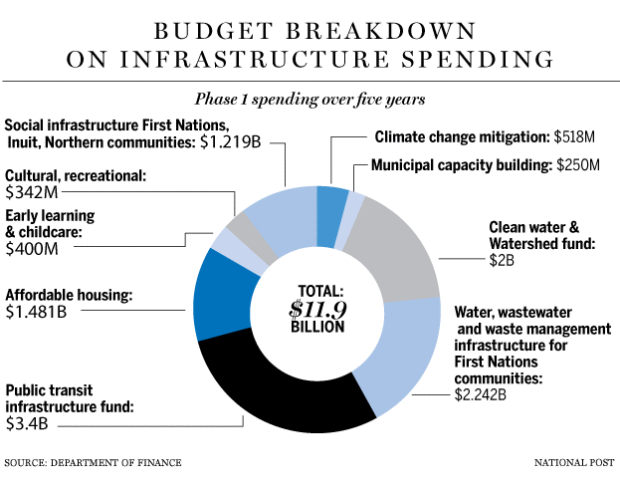

John Ivison: With federal budget, Liberals have consigned Canada to $118.6 billion deficits into next decadeLiberals to invest $11.9-billion on infrastructure over two yearsNew Canada Child Benefit puts ‘money in pockets of dad and mom,’ but not as progressive as some hoped

If there were any surprise within the budget, it had been that it lacked any real surprises.

“As important as government assistance is, what the Canadian middle-class needs most is strong economic growth. That’s the reason the federal government will make new investments in infrastructure everywhere to coast,” the finance minister said, sticking to the post-election script’s concentrate on infrastructure-based stimulus.

“New roads and bridges allow us to get around faster. Waste treatment plants, sewers and water mains keep water clean. Broadband connects us digitally. Social housing deliver affordable homes.”

Rebalancing the budget – a goal now expected to be reached by sometime after fiscal 2020-21 – will depend on the performance from the economy, both here and globally.

The new government is forecasting mostly meagre domestic economic growth over the short-term, improving only when and when global activity also picks up – improving our export earnings – and energy markets start to stabilize and costs oil prices set.

The authorities is projecting economic development of 1.4 per cent this year, after a 1.2-per-cent grow in 2015. For both 2017 and 2018, your budget calls for growth of 2.2 percent, accompanied by two-per-cent growth in 2019 before easing to 1.9 percent in 2020.

“I would treatment the four- and five-year projections having a hefty dose of salt,” said BMO’s Porter.

“Just to assume that things are likely to sail along for the next five years is a nice brave assumption. I’m sceptical of the large amount of forecasts going beyond a year.”

Up so far, the financial institution of Canada is doing a lot of the heavy-lifting for that economy by reduction of its trendsetting lending rate – twice in 2015, using the rate down to 0.5 percent, as the collapse of oil prices took an enormous toll on energy-reliant provinces, like Alberta and Newfoundland and Labour, and pushing the nation into a recession in the first couple of quarters of last year.

Even so, central bank governor Stephen Poloz and his monetary policy council are now sitting on the sidelines until the full scope – and its likely effect on the economy – of the Liberals’ fiscal plan continues to be digested.

The central bank’s next rate decision is placed for April 13, the same time frame as its next quarterly Monetary Policy Report – when the federal spending plans is going to be integrated into the bank’s economic outlook.

“To date, monetary policy is doing the majority of the operate in relation to shoring up growth prospects inside a cyclically weak environment,” RBC economics said inside a report released earlier this week.

“There are limits to what monetary policy is capable of and we’re nearer to those limits now than we have been in recent history,” RBC noted.

“While monetary policy can fight cyclical pressures, any hope at easing long term structural issues will need to originate from effective fiscal policy.”

Financial Post

gisfeld@nationalpost.com

Twitter.com/gisfeld

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news