The recent terrorist attack involving a bombing at the Brussels Airport hasn’t altered the Ontario Teachers’ Type of pension appetite for infrastructure investments, the plan’s chief executive said Wednesday.

Teachers’ owns a 39 per cent stake within the airport in Belgium, which was hit along with a busy Brussels metro station within an attack this month that left a lot more than 30 people dead.

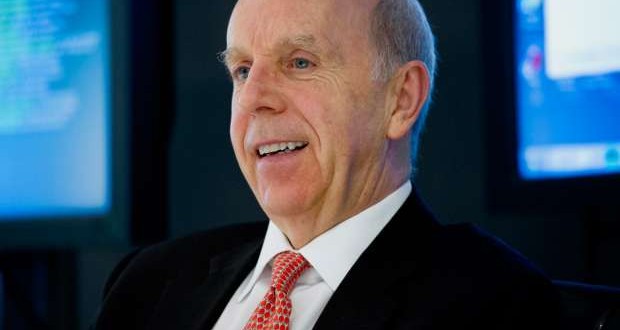

“It isn’t changed our take on infrastructure, it isn’t changed our view on the role, the key role, that infrastructure plays in satisfying our [long-term] liabilities,” Teachers’ CEO Ron Mock said during a media briefing to discuss the plan’s performance in 2015.

“We remain completely firm on infrastructure as an investment and we continue to scour the world for the best opportunities and will continue to do that,” he said, adding that the type of pension remains “100 per cent” dedicated to owning airports within the pension plan’s portfolio.

Teachers’ was a part of a consortium that outperform other bidders last month to purchase the London City Airport. The pension plan also owns stakes in stakes in Bristol Airport, Birmingham Airport, and Copenhagen Airports, the largest airport in Scandinavia.

Related

Ontario Teachers’ Pension Plan owns 39% stake in terror-targeted Brussels AirportCanadian pension plans buy London City Airport, but the rich price could drive away its biggest customer

Like other large Canadian pensions, Teachers’ continues to be an active investor in infrastructure recently. The infrastructure portfolio had $15.7 billion in assets after 2015, up from $12.6 billion last year. Infrastructure’s investment return for the year was 21.4 percent, handily beating a benchmark return of 14.3 per cent.

The infrastructure investments helped propel Teachers’ to some total rate of return on investments of 13 per cent for the year ended December 31.

Mock said the threat of the terrorist attack is “one of several risks” taken into account when Teachers’ makes an investment, whether it is within an infrastructure asset as an airport, or a large property asset such as a shopping centre.

“Clearly, Teachers’, if this makes them investments in infrastructure, it appears over the very long time horizon. A few of these concessions last for 20, 30 40, Six decades,” he explained. “Through time, unexpected things happen, things may happen, they can happen. You need teams that can cope with it.”

The type of pension has not yet received an estimate on the damage to the Brussels Airport, nor has it been decided when it will reopen, Mock said.

“There is a whole human side of the that you will find thought through carefully, just in terms of of people and personnel adapting to what took place, as you can imagine,” he said. “So they’re pretty much focussed on that and we’ve been in touch with the best minister’s office, offering our support and our sympathies, not to mention we’ve told the board and the CEO that we are behind them.”

The pension plan’s total net assets reached a record $171.4 billion after 2015, up from $154.5 billion a year earlier. Investment earnings for 2015 were $19.6 billion, up from $16.3 billion a year earlier.

“Despite volatile market conditions, Ontario Teachers’ global, diversified portfolio produced strong investment returns,” said Bjarne Graven Larsen, who became Teachers’ chief investment officer on Feb. 1. He added that “all departments fired on all cylinders last year.”

The pension’s performance beat a consolidated investment benchmark of 10.1 per cent, resulting in an “excess return” of two.9 percentage points, which means $4.2 billion in value added.

Since the plan’s inception in 1990, total investment income has accounted for 79 percent from the funding of members’ pensions, using the other 21 percent originating from member and government contributions.

Mock said he’s happy with the performance from the pension plan’s teams in Toronto, London and Hong Kong. He added the successful year was aided by the 2008 adoption of “condition inflation protection” through the plan’s sponsors.

The plan had a preliminary funding surplus of $13.2 billion by Jan. 1, the 3rd surplus in as numerous years. It had been 107 percent funded at the start of the entire year, according to current contribution and benefit levels.

Financial Post

bshecter@nationalpost.com

Twitter.com/BatPost

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news