ANKARA/DUBAI – Iran on Wednesday stopped short of offering to restrain oil output included in a worldwide pact to freeze production to support prices, because it wants to recapture the market share it lost during years of sanctions.

Sure, the Doha deal is flawed, but here’s why it could really make a difference to grease prices

Oil ministers from Saudi Arabia, Russia, Venezuela and Qatar announced an agreement to freeze their oil output levels provided other major producers follow suit.

Continue reading.

Iran’s stance will complicate talks on output levels following a surprise compromise this week between two world’s top exporters – non-OPEC Russia and the group’s leader Saudi Arabia – to freeze output at January levels, near their historic highs.

The first mooted global oil pact in Fifteen years has so far failed to impress the market, which had expected a production cut instead of a freeze that could even become a rise if Iran wins special terms from fellow OPEC members.

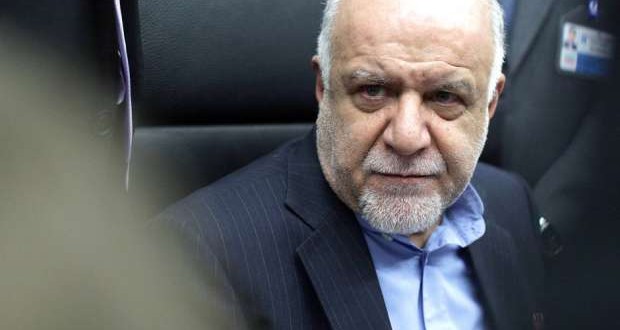

“This is the initial step and other steps should also be taken. This cooperation between OPEC and non-OPEC members to stabilize the marketplace is good news. We support any effort to stabilize the marketplace and prices,” Iranian oil minister Bijan Zanganeh said, according to the Shana news agency.

Zanganeh spent around two hours with oil ministers from Iraq, Qatar and Venezuela in Tehran on Wednesday. The visitors, who flew from Doha, where the output deal was clinched , left the Tehran meeting without comment.

Oil extended gains following a end of the meeting. Brent was up US$2.25, or 7 per cent, at US$34.43 a barrel by 1:25 p.m. EST (1825 GMT).

U.S. crude was trading US$1.65, or 5.7 per cent, higher at US$30.69 a barrel.

Zanganeh spoke to Iranian media afterwards and chose his words carefully to prevent mentioning Iran’s position on freezing its very own output.

“We were built with a good meeting today and the report of yesterday’s meeting was handed to all of us. We support cooperation between OPEC and non-OPEC members.

“I was told that Russia as the world’s biggest oil producer, Oman along with other countries will be ready to join. This is a positive step, we have a positive approach to it, this is a good start,” he explained.

Related

Saudi Arabia and Russia agree to freeze oil output, but deal ‘not worth much’ without Iran, IraqFrozen pipelines, expensive tankers with no storage: Russia’s hesitation to chop oil output more than political

ILLOGICAL DEMANDS

OPEC Gulf producers Qatar, Kuwait and also the UAE, as well as Venezuela said they’d join the Russian-Saudi pact, aimed at tackling a growing oversupply and helping prices get over their lowest in over a decade.

But Iran is the major obstacle to the first joint OPEC and non-OPEC deal since 2001, having pledged to improve output sharply to regain share of the market lost during sanctions.

“Asking Iran to freeze its oil production level is illogical … when Iran was under sanctions, some countries raised their output and they caused the stop by oil prices.” Iran’s OPEC envoy, Mehdi Asali, told the Shargh daily newspaper before the talks on Wednesday.

The sanctions, imposed over Iran’s nuclear program, were lifted last month after an agreement with world powers, allowing Tehran to resume selling oil freely in international markets.

Iran exported around 2.5 million barrels per day of crude before 2012, but sanctions cut that close to 1.1 million bpd.

Tehran has pledged to boost supply by around A million bpd within the next 6-12 months as well as on Wednesday some Iranian banks were reconnected to the SWIFT global transaction network, that will allow it to facilitate banking business.

SPECIAL TERMS

Iranian barrels would only increase the global glut, that has been fueled by U.S. shale output along with a decision by Saudi Arabia to function at full capacity to drive higher-cost producers out of business.

The world is already producing more than 1 million bpd than it consumes, with oil stockpiles at record levels.

As an effect, prices fell below US$30 per barrel in January from up to US$115 in mid-2014, hammering the finances of Russia, Saudi Arabia along with other producers.

Brent oil futures rose over 7 per cent on Wednesday after losing around 4 percent the day before to trade near US$35 per barrel..

“A freeze is not the same as a cut, and somewhat disingenuously, keeping crude production at January levels actually implies higher-than-expected annual output … and so can hardly tackle the current market oversupply,” JBC Energy said in a note.

Two non-Iranian sources close to the OPEC discussions told Reuters on Tuesday that Iran may be offered special terms included in an output freeze deal. “Iran is returning to the market and needs obtain a special chance, but it also must have calculations,” said one source.

The sources didn’t elaborate on the special terms, that could be everything from setting limited production increases to linking future output rises to a recovery in oil prices.

Olivier Jakob from Petromatrix consultancy said that if Saudi Arabia were to freeze output at January levels, the dominion will have to cut exports by 500,000 bpd in the summertime months, if this burns more oil for power generation at home.

“The production freeze can therefore be viewed being an un-official way for Saudi Arabia to create some room for the restart of the Iranian exports,” he explained.

The last global deal in 2001 saw Saudi Arabia persuade Mexico, Norway and Russia to bring about production cuts, although Moscow didn’t follow-through and raised exports instead.

? Thomson Reuters, with files from Bloomberg

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news