With budget time approaching at the federal and provincial levels, finance ministers will attempt to solve the quandary of yawning deficits in the existence of slow growth. Should governments take on fiscal stimulus C more spending or tax cuts C that will boost the deficit and, hopefully, spur growth? Or whenever they take on austerity to prevent the stress of high debt loads?

The concern is especially acute within the Atlantic provinces using their high indebtedness and slow growth. New Brunswick’s recent budget will reduce its top personal income tax rates to offset the Trudeau tax hikes while raising the HST and corporate income tax rates by two points. With cuts to spending after last year’s hyped infrastructure plan, the province has decided on the austerity route instead.

Fiscal stimulus or austerity alone won’t provide long-term growth. With the commodity market slowdown, the Atlantic provinces have to consider path-breaking structural reforms for their spending and tax habits to shock their economy into better growth. New Brunswick, for example, has got the worst growth record in the country since 2010 as well as an economic development strategy that merely won’t work.

Related

Joe Oliver: Why equalization no longer worksPeter Foster: Better delivery for bad Liberal policyTrevor Tombe: How to create two jobs for each Canadian worker

A bit of history here could be instructive.

When Liberal Frank McKenna was premier of New Brunswick, he understood so good tax, regulatory and spending policies can generate growth. For instance, by relating workers-compensation payroll contributions to a firm’s safety experience, New Brunswick’s call centre industry was spawned. Progressive Conservative Bernard Lord also understood that tax competitiveness can contribute to better growth. Liberal Shawn Graham looked to the Irish model by reduction of personal and company rates to become the most attractive in Canada.

Unfortunately, the Graham government erred by cutting income taxes without a corresponding increase in the HST to avoid large deficits. Confronted with large recessionary deficits, the PC Alward government rescinded tax reductions, a poor strategy when compared with raising the HST, that is less bad for growth. With the Liberal Gallant government, New Brunswick has hiked its top personal and corporate tax rate to be one of Canada’s highest in addition to raising the HST rate to 15 percent, tied with Nova Scotia to become Canada’s highest.

Gallant also froze shale gas development this past year. Resource production is falling badly as Saskatchewan’s Potash Corp. is closing its major potash mine. Gallant is relying on the power East pipeline to become created to the Irving refinery as his major development strategy, a risky proposition at best.

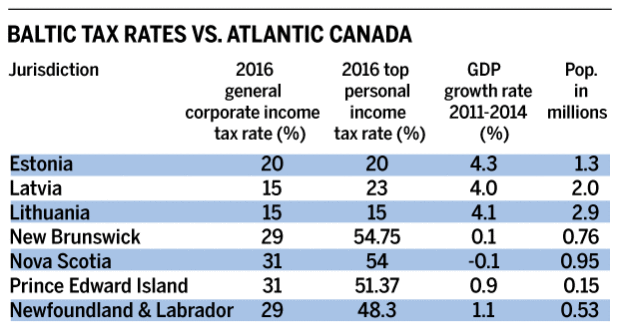

The other Atlantic provinces, steeped in deficits, face similar fiscal dilemmas. All have corporate income tax rates above Canada-wide and OECD levels. Aside from Newfoundland and Labrador, they’ve French-like top personal income tax rates, and therefore are growing even less than Europe’s snail’s pace of 0.7 percent.

Are the provinces doomed to a poor economic future or might another strategy succeed? A recent German academic publication on the Baltic Tigers, whose small populations resemble the Atlantic provinces, provides the clue. Estonia, Latvia and Lithuania have been enjoying strong economic growth since 2003 by pursuing different economic reforms.

When the 3 Baltic Tigers shook off their Communist tyranny two-and-a-half decades ago, they took on radical reforms including deregulation, privatization, trade liberalization, currency and inflation stabilization, balanced budgets and major tax and spending reforms. The Tigers not just shifted public spending towards infrastructure and education (Estonia now has one of the best education systems in the world), they also pursued tax reforms including a low-rate flat income tax. Estonia continues to be particularly successful in rooting out corruption.

The Tigers grew at outstanding rates, as much as 10 % from 2004C07. Once the global financial crisis pulled the rug from under them, they resumed the early 1990s radical reform strategy, closing down failing banks without compensating former owners and rejecting the advice of Keynesian economists to defend myself against fiscal stimulus. They adopted austerity measures to limit budget deficits, tax reforms, privatizations and labour market deregulation. The Baltic Tigers recovered from their deep recession with small fiscal deficits and reasonable debt levels by 2014. Growth has returned to levels 4 times greater than Europe’s since 2011, at over four per cent.

I am certain that the Atlantic provinces would much prefer growing at four percent annually over their anemic performance. Instead of New Brunswick’s doomed high-tax, anti-development approach, another three provinces need to look at small jurisdictions such as the Baltic Tigers that demonstrate that low taxes, regulatory reforms and smart public spending yield great results.

Jack M. Mintz may be the President’s Fellow, University of Calgary’s School of Public Policy, and Scholar-in-Residence at Columbia Law School. He’s been an adviser on tax policy to four past New Brunswick governments.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news