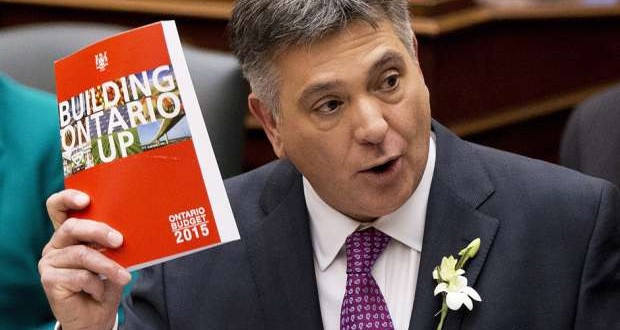

With Ontario’s 2016 budget set to land in a few days, all eyes are on how the province plans to balance the remaining $7.5-billion deficit after next fiscal year. But a brand new report is providing a different narrative, in hindsight at how the provincial deficit ballooned to that particular amount in the first place and suggesting it might possess a multi-billion surplus instead.

The provincial books have been in the red since the 2008/09 recession, and lots of were sceptical the Liberals could balance by the long-promised 2017/18 deadline. They’re likely to finally hit the black, but not before Ontario’s debt tops $298 billion sometime this year. Along with a new Fraser Institute report finds it didn’t have to be this way, in fact, it argues Ontario could have from a $10 and $15 billion surplus.

How?

If it had held spending growing to inflationary pressures in the last decade.

Prevailing logic has held that decreased revenues during the recession, cuts in federal transfers and investments intended to boost the economy increased the deficit, but Fraser Institute says spending decisions through the Liberal government was the biggest contributor.

“The string of deficits in Ontario and the resulting dramatic run-up in provincial debt was avoidable and never the result of factors beyond the provincial government’s control,” authors Ben Eisen, Charles Lammam and Milagros Palacios write in a bulletin released Thursday.

The authors reason that demands on Ontario’s services grew slower than spending. Between 2003 and this year, inflation and population in Ontario grew a combined 2.8 percent, while nominal GDP grew 3.2 percent, and government program spending grew an average of 4.7 per cent in the last decade. The authors in turn reason that, had Ontario kept spending to the level of GDP growth or even population demands, the 2016 budget would produce a major surplus.

“If the province had restrained program spending growth towards the rate of the nominal GDP growth since 2003/04, the Ontario government could be projecting a $10.7 billion surplus this fiscal year rather than a $7.5-billion deficit,” the report states. “If program spending have been held towards the pace of inflation plus population growth within the period, the extra in 2015/16 would be even larger, at $15.1 billion.”

The value of a deficit, however, is in the eye of the beholder. Those who like the big programs the Liberals have built could defend those deficits as necessary. Tuition rebates and also the Ontario Child Benefit have helped level the playing field for a large number of young adults and long-overdue but still modest investments happen to be made to the welfare system.

And yet, balancing the books is essential not just in how credit score agencies rank the province, but additionally to business confidence. In a separate report released on Thursday, the Ontario Chamber of Commerce found that 92 per cent of its members consider balancing the books and tackling the debt a top priority. Interest payments already top $11 billion a year – the third-highest single program spending area behind healthcare and education and more than the province spends on its entire welfare system.

Its members also express concern on the potential costs from the pending cap-and-trade program, with 32 percent dreaming about clarity in the budget. And it calls on government to reinvest that money in programs which help businesses transition to a lower-carbon economy – something already underway with an announcement Wednesday of $100 million in grant money to complete exactly that.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news