CALGARY — Shareholders are pushing Canada’s dominant oilsands player to supply more detail on two sticky topics: its intends to thrive under tougher climate policy and its political lobbying.

Separate shareholder proposals happen to be filed in front of Suncor Energy’s annual general meeting next month — with one greeted a lot more warmly than the other by the company.

The board of Calgary-based Suncor is recommending shareholders vote in favour of NEI Investments’ resolution that the company “provide ongoing reporting on how it’s assessing, and ensuring, long-term corporate resilience in a future low-carbon economy” — a move considered unusual.

However, the organization is pushing back against a proposal by another group of shareholders co-ordinated by Amount of Us, a company that campaigns for corporate accountability. That one urges Suncor to report annually on its lobbying policies and procedures, the total amount it’s paying and also to whom, and it is decision-making process and oversight.

NEI decided to target Suncor around the climate proposal for a simple reason, said Jamie Bonham, who led the effort.

Related

Canada’s biggest oil producers are sitting on a near-record pile of money amid price routSuncor Energy Inc gets enough support to shut its Canadian Oil Sands Ltd acquisition

“We thought Suncor was probably the most ready for this,” he explained, adding the oil company’s support is “relatively unprecedented” in North America.

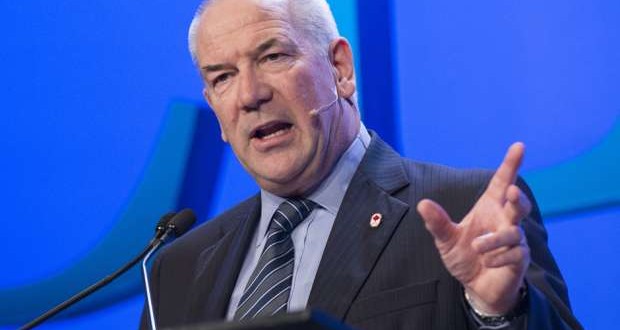

Suncor CEO Steve Williams has stumped for tougher carbon pricing and was one of four energy bosses to face alongside Alberta Premier Rachel Notley last November when she unveiled the province’s new sweeping climate plan, which includes a $30-a-tonne carbon tax in 2018.

Bonham said while Suncor is a leader around the issue, “it’s still a large question mark as to how such a big oilsands player is going to thrive in a low carbon future.”

Similar proposals around climate risk happen to be endorsed by some European energy majors.

“When Shell and BP and Statoil supported the resolutions this past year, it wasn’t uncommon, but it was really unusual,” said Andrew Logan, with Ceres, a U.S. corporate sustainability not-for-profit group.

“I’m able to never remember it happening with an issue which was so proportional to the company’s core business.”

Suncor’s Peter MacConnachie, who works with environmental groups and socially responsible investors, said as a result of the resolution, Suncor will be providing more detail on its plans under a a few different scenarios.

“Because of the evolving conversation about climate, we believe it’s a worthwhile chance to provide additional information to shareholders about how exactly Suncor will flourish in a lesser carbon economy,” he explained in an emailed statement.

NEI’s Bonham said the problem is going to a vote because shareholder buy-in is vital.

On the lobbying resolution, Suncor said hello already matches laws that need it to disclose its activity through federal and provincial online registries.

Sum People enlisted three shareholders having a collective $70,000 in company stock to file the proposal.

Lisa Lindsley, who manages shareholder advocacy campaigns at Amount of Us, said the shareholders had a few conversations with Suncor, but came away unsatisfied.

The shareholders wanted to draw more attention to the trade associations to which Suncor belongs. The resolution cites “reputational risk” if a person of those groups finds itself embroiled in a scandal or if its agenda runs counter to Suncor’s stated green goals — a trade group lobbying against stricter environmental rules, for example.

“Really what they offered ended up being to list all of the trade associations and organizations that they pay over a certain threshold amount,” said Lindsley.

“We didn’t believe that that really got to the data that shareholders required to assess the perils of Suncor’s political spending.”

MacConnachie, with Suncor, said the organization doesn’t observe how that additional detail is needed investors make better decisions, given that those associations are bound by the same lobbying disclosure laws.

Kevin Thomas, with Shareholder Association for Research and Education, worked with investors in pipeline heavyweights Enbridge Inc. and TransCanada to push for improved lobbying disclosure and wound up working out a deal in both cases.

The Enbridge proposal is made on behalf of the Pension Plan from the United Church of Canada, as the TransCanada one was for that Fonds de Solidarite des travailleurs du Quebec. Both were withdrawn.

Thomas said counting on registries alone means some activity will “come under the radar.”

“I don’t think it’s reasonable to anticipate investors to visit and search every provincial, municipal, federal and other country levels to understand what their very own clients are doing.”

The Canadian Press

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news