Commodities including oil and copper are in chance of steep declines as recent advances aren’t fully grounded in improved fundamentals, according to Barclays Plc, which warned that prices may tumble as investors rush for the exits.

Canada’s recovery in danger of ‘twilight zone’ of low oil and rising loonie

Canada’s economy risks getting caught in a bind where oil costs are less than sufficient, however the loonie isn’t very reasonable enough, economists warn. Read on

Canada’s economy risks getting caught in a bind where oil costs are less than sufficient, however the loonie isn’t very reasonable enough, economists warn. Read on

Copper may slump to the low US$4,000s a metric ton, from US$4,945 working in london a week ago, while oil could fall back to the low US$30s a barrel, analyst Kevin Norrish said inside a note. The danger for recycleables is that investors seek to liquidate bets on gains quickly and in unison, with potentially highly negative consequences, Norrish wrote in the note entitled “Buffalo Jump,” a phrase that describes a cliff where Native Americans herded bison for their death.

“Investors happen to be drawn to commodities among the most effective assets so far in 2016,” he explained in the March 28 report. “However, even without the any concerted fundamental improvements, those returns are unlikely to become repeated in the second quarter, making commodities vulnerable to a wave of investor liquidation.”

Commodities rebounded from the a lot more than 25-year lower in January amid speculation that prices may certainly be bottoming after they lost 11 percent within the final 3 months of 2015 and 14 per cent in the third quarter. Oil and copper have recovered from the multi-year lows seen in the January and February, and Barclays estimated net flows into commodity products totalled a lot more than US$20 billion in the two-month period in the strongest begin to annually since 2011.

“Given that recent price appreciation does not appear to be very well founded in improving fundamentals, which upward trends may prove difficult to sustain, the risk keeps growing that any setback will result in a rush for that exits that could again lead commodity prices to overshoot towards the downside,” he said.

Investors were increasingly taking short-term bets on raw materials, not the long-term buy-and-hold technique for diversification and inflation protection that underpinned inflows in the previous decade, he explained. In addition, as commodities are some of the few assets which have risen in the first quarter, that may make investors keener than normal to shut out bets on gains, he said.

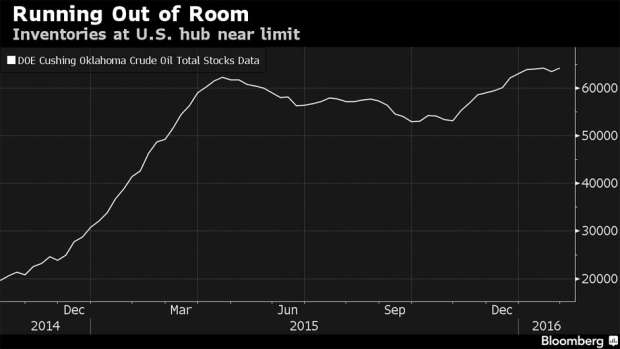

“Key commodities markets for example oil and copper already face overhangs of excess production capacity and inventories, but additionally now face another obstacle in the recovery process, those of positioning, that is now approaching bullish extremes,” Norrish said.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news