Major oil companies happen to be jettisoning projects, slashing capital expenditure and scrapping ambitious plans around the globe in an age of austerity within the energy patch due to the decline in oil prices from a lot more than US$100 per barrel of West Texas Intermediate crude last June to less than US$30 at some point in mid-January.

Why your budget set an ‘excessively low bar’ with US$25 oil price – and what this means for Ottawa’s spending

Ottawa could still meet its budget targets if oil prices fall to US$25 a barrel, thanks to a $6 billion contingency fund Finance Minister Bill Morneau has generated into the budget

Read more

Canada’s traditional energy patch is not spared. Indeed, the oilsands has perhaps been hurt first and foremost, given the high cost of extracting and refining. But there is still one place in Canada that’s defying the chances, where development continues and wants a brighter future remain high – the East Coast.

Despite the rout in oil prices, Royal Dutch Shell PLC, Exxon Mobil Corp., BP PLC and Husky Energy Inc. are persevering with plans for exploration activities within the Atlantic Ocean, and not just in favoured Newfoundland and Labrador but also in greenfield offshore Quebec.

The hulking Exxon-Mobil-operated Hebron development is going up 350 kilometres southeast of St. John’s, while Royal Dutch Shell’s drillship is patrolling the Shelburne Basin 250 kilometres south of Halifax. In the Flemish Pass Basin, partners Husky Energy Inc. and Statoil ASA are difficult at work in the Bay du Nord, looking to repeat their stunning discoveries in the region in the past couple of years.

At the height of the oil price downturn last November, companies for example Chevron Corp. and Statoil ASA forked out just over $1.2 billion in work commitments for seven parcels provided by the Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB).

“Newfoundland and Labrador offshore is among the last great undeveloped frontiers left on the planet,” said Ed Martin, chief executive of Nalcor Energy, the province’s energy corporation. The spate of renewable and hydrocarbons project would see Nalcor’s net gain grow more than tenfold to as much as $500 million “in a few short years,” according to the company.

We are most likely on the verge of renaissance in exploration.

The oil majors’ pursuit of East Coast licences is available in sharp contrast for their hasty retreat in comparable jurisdictions, such as offshore West Africa, its northern border Sea and Western Canada, in which a number of conventional and oilsands projects have been shelved.

The New england has largely ducked the great retreat from offshore activities globally, thanks to expensive long-term contracts sealed throughout the heady times of US$100 oil.

“We are probably near renaissance in exploration,” said Robert Cadigan, president of Newfoundland Labrador Oil & Gas Industries Association.

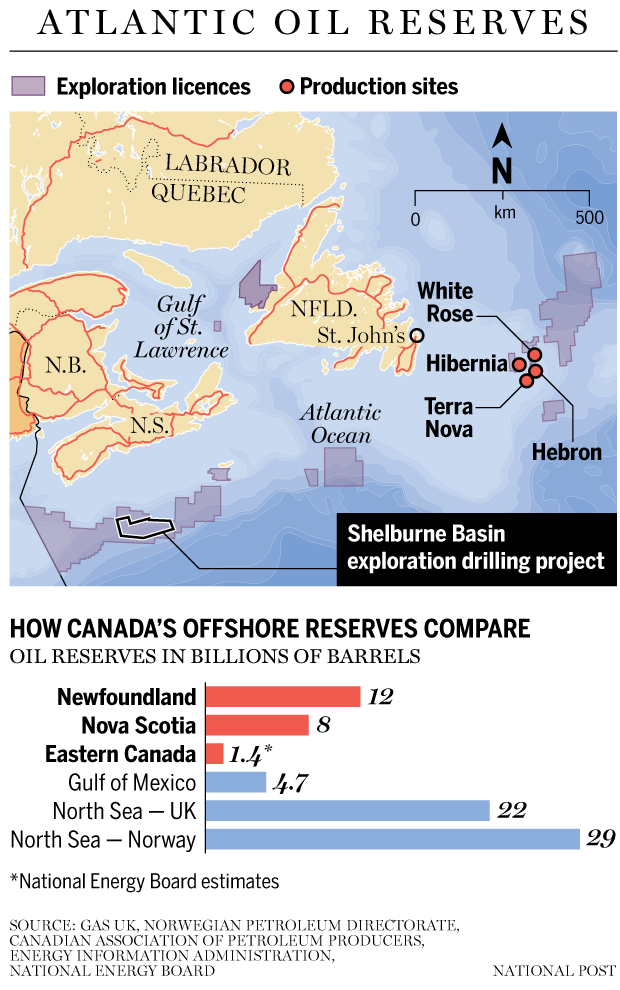

The big prize for oil companies is the projected 12 billion barrels of oil off Newfoundland, too another eight billion barrels of oil approximately off Nova Scotia, according to the provinces’ estimates.

“We only have five per cent of our massive offshore area under licence at this time,” Martin said. “We have got an area of deepwater that’s 50-per-cent larger than the Gulf,” which boasts reserves of around 4.7 billion barrels.

Norway-based Statoil would be a partner in five of the seven bids in November as well as clinched a solo bid worth $423 million. Its curiosity is clearly piqued by its trio of mega discoveries in the Bay du Nord, 500 kilometres northeast of St. John’s, recently.

Oil companies have experienced an on-again/off-again relationship using the New england, but Nalcor embarked on an extensive data-gathering program not too long ago to keep its romance alive with oil majors.

The 2-D seismic data it collected, from a place spanning 110,000 kilometers from the tip of Labrador, bordering Greenland, right down to the Flemish basin area, certainly yielded early results.

“What’s been discovered through that (program) are three new basins in Labrador that we did not know existed,” Cadigan said.

Despite the enthusiasm, you will find signs that the realm of US$40 oil may finally be doing the Atlantic, but it’s not had nearly the outcome it’s been on other locations.

“The dip in activity in the New england was not the same as the thing is elsewhere in West Africa and the North Sea,” said Luke Davis, a London-based analyst at Infield Systems, although he adds that exploration activity is another fraction of the competent and busier offshore sites.

One reason behind the lag in activity, Davis said, would be that the New england is a high-cost region, and it is susceptible to exactly the same stresses as otherwise.

“There are additional issues with Canada, and one of them pertains to what’s needed for flow testing on new discoveries which boosts the price of exploration -” he explained. “The cost of a single exploration well around the New england would be greater than it would be for that North Sea.”

Freezing temperatures and volatile weather could also keep oil companies at bay, especially since Shell’s retreat from the Alaskan Coast this past year shows oil companies haven’t yet master more inhospitable conditions.

Already, Shell’s $1-billion offshore exploration program in the Shelburne Basin continues to be put on temporary hold after a piece of equipment from the drill ship broke because of severe weather conditions. An investigation is underway and drilling operations will stay suspended while repairs are performed, said a Shell spokesperson.

The setback is much more fuel for that rising opposition to offshore and inland drilling activities in the Atlantic, and could deter more exploration at any given time when an ecological disaster could spell doom for the entire basin.

BP, which is familiar with offshore setbacks, could miss its first-quarter deadline to announce the location of their first well in the Scotian Basin, which is expected to commence in 2017. The company didn’t react to request comment.

Husky has additionally deferred a final investment decision around the White Rose Extension Project.

“We are seeing some delays offshore with regards to some of the field work that was contemplated,” said Paul Barnes, Atlantic Canada manager at the Canadian Association of Petroleum Producers. “Our fear is, obviously, if that downturn is sustained beyond this year, that will certainly impact offshore exploration activity.”

Nevertheless, existing plans have not been scrapped. Husky drilled two new wells at the South White Rose Extension this past year and plans to spend as much as $500 million this year. And the company is in the midst of an exploration and appraisal program at the Bay du Nord discovery area along with partner Statoil.

Husky also signed a two-year contract last December to secure the harsh-environment Henry Goodrich rig, starting from the mid-2016 timeframe, for ongoing development drilling in the South White Rose Extension and North Amethyst field.

The most promising development may be the Exxon Mobil-operated Hebron project within the Jeanne d’Arc Basin, set to commence operations in 2017. Speculation persists that the development may be delayed, but Nalcor, with a stake in the project, believes Exxon will keep to the deadline.

Our fear is, obviously, in the event that downturn is sustained beyond this season, that would certainly impact offshore exploration activity.

Hebron is an engineering marvel, rising 165 metres in the sea floor, a shade taller compared to TD Waterhouse Tower in downtown Toronto, and comes with a “metal hotel” featuring gymnasiums, music rooms and living space for that 220 personnel aboard. It’ll yield 150,000 barrels a day from the field containing 700 million barrels, that will then likely head to continental Europe, that is eager to reduce its dependence on Russian supplies.

The project should also boost Newfoundland’s annual offshore production, which has steadily declined over the past decade, falling to 62.Six million barrels last year from its peak of 134 million barrels in 2007, according to the offshore regulator C-NLOPB.

Key producing fields such as Hibernia, led by Exxon Mobil, Terra Nova, spearheaded by Suncor Energy Inc., and the White Rose and North Amethyst oilfields, majority-owned by Husky, all suffered declines.

Nalcor’s Martin believes the launch of predictable annual licensing programs and seismic data “packaged having a bow” should keep production declines in check within the long run.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news