New Gold Inc. was braced for a vicious backlash in the investment community when it decided to hedge some gold production earlier this year.

After all, hedging is the gold industry’s ultimate dirty word. It became this type of toxic subject over the past decade that many chief executives decided that even talking about it had been off limits. And New Gold is led by Randall Oliphant, who headed up Barrick Gold Corp. back when it had the biggest – and most reviled – hedge book in the industry.

But the response to New Gold’s move wasn’t negative. Instead, just about everyone cheered.

“We’ve heard nothing but positive reactions from shareholders, analysts and media individuals to what we should did,” said Oliphant, New Gold’s executive chairman. “So that will give individuals that do sort of stuff some ammunition.”

New Gold’s hedge position is pretty minor in the grand scheme of things. The Toronto-based miner entered option agreements to sell 270,000 ounces of gold at prices no less than US$1,200 an oz. New Gold is spending a hefty US$500 million on an Ontario gold project in 2016, and this small hedge position simply ensures that it can build the mine and maintain a proper balance sheet even if gold prices use the tank.

Still, this deal violated one of the industry’s biggest taboos and it took some nerve for brand new Gold to do it. But the warm reception it received, combined with recent rally in gold prices, suggest there could be much more hedging in the future.

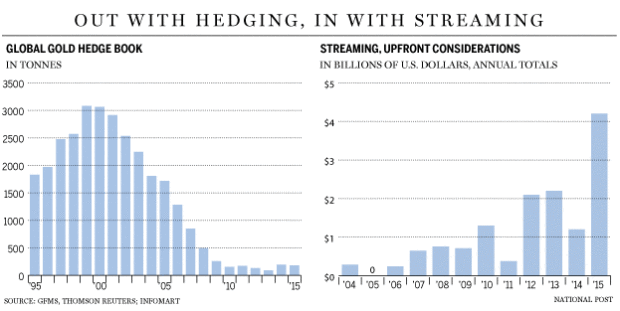

The heyday of hedging came in the 1990s and early 2000s, when gold was mired inside a prolonged bear market. Companies such as Barrick, Newmont Mining Corp. and AngloGold Ashanti Ltd. hedged millions of ounces of future production to lock in profitability in their operations. The practice peaked in 1999, when more than 3,000 tonnes (or over 100 million ounces) of gold was hedged.

Anti-hedgers ignore a clear truth: throughout the bear market, hedging often paid off

The gold bugs despised this financial engineering, because miners were giving away much of the upside to rising gold prices. Obviously, one reason for the hedging could be that the mining companies simply didn’t believe gold would go up around it did.

But the anti-hedgers ignore an obvious truth: throughout the bear market, hedging often repaid.

Barrick, for one, grew into the world’s biggest gold miner mainly due to its hedge book, which allowed it to make more profit per ounce than many of its rivals. Consequently, its stock traded confined to many of the sector, also it could then use that stock as currency for acquisitions.

But the downside of hedging became obvious when gold began its long upward climb in 2001. As prices rose far beyond the amount at which companies hedged, the industry’s hedging liability became bigger and bigger.

The smarter companies, such as Newmont, eliminated their hedges relatively early in the bull market. Barrick, on the other hand, waited until 2009, at which point gold had quadrupled from the lows and was worth roughly US$1,000 an oz. The company wound up issuing US$4 billion worth of stock – still the biggest equity offering in Canadian history – just to unwind its 9.5-million-ounce hedge book.

Related

Eldorado Gold Corp suspends dividend because it reports monster $1.24 billion lossHere’s one reason why silver miners are hitting 52-week highs on the S&P/TSX Composite indexWhat Ontario must unlock Ring of Fire’s mineral wealth is a Marshall Plan

No one desired to replicate that nightmare, and hedging was virtually dead through the dawn of this decade. Just 152 tonnes of gold remained hedged at the end 2010, based on GFMS analysts at Thomson Reuters, which is under five per cent from the 1999 peak. By 2012, that figure was down to 130 tonnes.

Gold prices rose each year between 2001 and 2012, so there had not been shareholder support for hedging. Hedge funds along with other institutional investors were piling into the sector to get exposure to gold’s rising fortunes, plus they wouldn’t touch a business having a significant hedge book.

But the gold bull market ended abruptly early in the year of 2013, when prices plunged 25 % within weeks. Gold miners suddenly realized a regrettable truth: many of them weren’t coming to a money.

Had they hedged some production at any point previously 2 yrs, they’d have formulated an excellent buffer against falling prices. Instead, some of them struggled just to stay afloat and manage their large debt loads.

The gold market has turned positive again in 2016. Prices have jumped around 20 percent since the start of the year (they continue to be above US$1,200 an ounce despite slipping last week) so it makes sense for businesses to consider seriously about hedging again.

New Gold announced its hedge on March 8. Just 7 days later, Canadian miner B2Gold Corp. announced it is raising as much as US$120 million from prepaid gold sales, which amounts to a form of hedging. That capital is going to be used to build B2’s Fekola mine in Mali.

Hedging is gaining popularity outside Canada too. Several Australian and Africans firms, including Evolution Mining Ltd. and Acacia Mining PLC, have announced new hedge positions recently, as has Polyus Gold, Russia’s leading producer.

These transactions, all of which are relatively modest in size, indicate exactly what a new trend of hedging could seem like. It won’t be the massive financial engineering schemes of days past that were orchestrated by corporate finance whizzes attempting to outsmart the gold market.

Instead, it will be utilized in small, targeted doses by companies looking to protect their balance sheets or reach a specific goal, such as funding a brand new mine.

“Hedging for any specific reason or a specific project has always designed a large amount of sense in the mining industry,” said Clive Johnson, B2Gold’s CEO. “The fact of the matter is the fact that (Barrick and others) gave it a poor name. However i never visited.”

Despite the little revival this year, it remains to be seen if hedging can totally shed its negative stigma and gain wide acceptance again. Still it is not a word many executives will say out loud.

But as hedging went out of favour over the past decade, the industry embraced another financing scheme that has some similarities: metal “streaming,” in which a mining company receives upfront cash from a streaming firm (for example Silver Wheaton Corp.) in exchange for future sales of physical gold and silver at below-market prices.

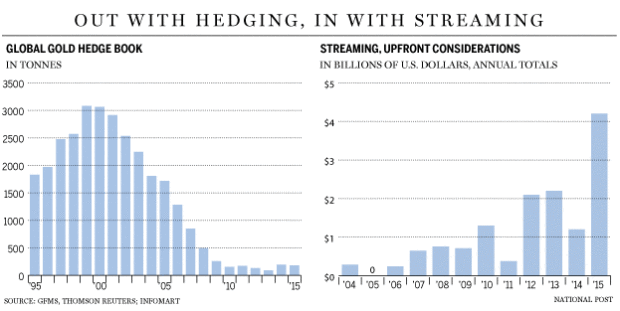

Mining companies raised US$4.2 billion from stream sales in 2015 alone, according to Financial Post data. Barrick, Teck Resources Ltd. and Glencore PLC are among the firms that eagerly sold streams this past year.

Some experts are surprised that streaming has become very popular while hedging remains beyond the pale. In a few circumstances, streaming can be very expensive. If metal prices go up following a stream sale, the miner ends up offering a great deal of profit.

Streams also usually continue for the entire life of a mine, and include the exploration upside. Therefore if a company finds more gold or silver on its property after signing this type of deal, it must sell some of this new discovery within the stream too.

Johnson said the streaming model doesn’t seem sensible for an organization for example B2Gold, with a well-regarded exploration team and it is known for buying projects and then finding more gold in it.

“The streamers desire a piece of the upside forever,” Johnson said. “With our ability to find more ounces, there’s no way I will give those up.”

There has been some backlash against streaming deals recently, as commentators have expressed concern that miners are giving up too much upside to get immediate influxes of cash.

Ironically, those concerns could pave the way for more hedging, which faced similar criticisms 2 decades ago.

Ron Stewart, an analyst at Dundee Capital Markets, said there are still lots of investors that see hedging as an “evil financing tool.” But those same people probably think streaming deals are too expensive and may see them being an even worse alternative.

“It might actually be that streaming and royalty deals have turned hedging back to something that is a little bit more palatable,” he said.

For New Gold’s Oliphant, the argument in favour of hedging is much simpler. He pointed out that gold was US$1,050 an oz just three months ago, when compared with Thursday’s closing price of US$1,223 and a peak of US$1,277 earlier this year.

Miners generally have short memories, however, you have no need for a long someone to recall how much the industry was suffering at US$1,050 an oz just 3 months ago. Back then, locking in a floor price almost 15-per-cent higher, as New Gold just did, would have felt wonderful become a reality for a lot of executives.

“People know exactly how they felt when we were at those low prices,” Oliphant said.

pkoven@nationalpost.com

Twitter.com/peterkoven

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news