Given the possibility, not too many borrowers would pass the opportunity to tap into a new group of investors and raising debt capital.

But opportunities aren’t given. Instead, they have to be created because the province of Bc discovered now when it priced its first so-called Panda bond. The text – B.C. will borrow 3-billion renminbi around the inshore Chinese bond market – came with a couple.95 per cent coupon and a three-year term.

It’s understood the province may be the first sovereign to gain access to within the Panda market – though at least two international borrowers, the International Financing Corp. and also the Asian Development Bank, have risen capital there in the past.

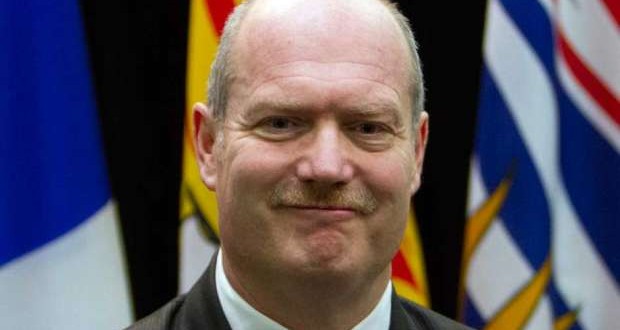

Michael de Jong, the province’s Finance Minister, said the bond issue “represents our commitment to build stronger, better quality ties with China’s financial and economic markets and the broader Asia-Pacific region. British Columbia’s triple-A credit score gives our Province use of markets and investors we couldn’t otherwise reach, and China’s onshore market provides use of an assorted, relatively untapped group of investors.”

This week’s issue came under 8 weeks after the province was granted approval for a 6-billion RMB program.

It needs time to work and lots of negotiations to stay in a position to raise debt capital in China. And de Jong, the finance minister since September 2012, has invested the so-called hard yards in link building with China. He has been there on six occasions (twice in the past 8 weeks) and, to the chagrin of his staff, travels economy class.

Here are a few key milestones of the items de Jong continues to be able to achieve:

November 2013: The province became the first foreign government to issue a bond into China’s offshore RMB market. In most it raised 2.5-billion RMB, ($428 million) in the sale of the one-year bond costing 2.25 %. At that time the financing was the largest in that market with a foreign issuer. Asian investors (which bought 60 per cent from the issue) and central banks and official institutions (which bought 62 per cent from the issue) were the biggest buyers.

November 2014: In its second offer the offshore market, the province raised 3-billion RMB ($559 million) at 2.85 percent for 2 years.

The issue coincided using the announcement by the governments of China and Canada that designated a Canadian RMB trading hub. (While B.C. was vying to become the hub, the choice is made to award it to Toronto.) Until China operates a completely floating exchange rate regime, a domestic RMB hub can make use of renminbi in B.C.-China trade, commerce and investment easier for Canadian banking institutions as well as their customers.

Barclays on the sheet

What have you done for me personally lately?

In the situation of Barclays Canada the reply is a good bit.

It has its name around the two large mergers and acquisitions announced this year: the $2.65 billion purchase by Corus Entertainment of Shaw and also the $582 million purchase by Aviva Canada of RBC General Insurance Co.

On the Corus/Shaw deal, Barclays, acted for that special committee of Corus as independent financial advisor and valuator (where it opined that Shaw Media was worth between $2.45 billion and $2.85 billion). On the RBC/Aviva deal it acted for the U.K. based buyer and its Canadian unit.

RBC Capital Markets seemed to be involved on those two deals.

bcritchley@nationalpost.com

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news