Some Canadian banks might be forced to preserve capital by raising equity or perhaps cutting dividends if oil prices continue to slump, Moody’s warns inside a new report.

In a “severe stress” scenario modelled through the ratings agency, and included in the are accountable to be widely circulated Monday, losses in consumer lending portfolios would exceed historic peaks and capital markets activity in the country’s biggest banks would be significantly crimped.

“Under the moderate stress scenario we modeled, the profitability of Canadian banks will decline but their capital would not be impaired,” David Beattie, a senior vice-president at Moody’s, wrote in the report.

Related

Equitable Bank can not maintain interest in 3% interest savings accountsBarclays Capital gets downright bearish on Canada’s banks, slashes price targets typically 20 per centThe bleeding isn’t over for that energy sector, regardless of the Saudi Arabia-Russia oil deal

“In our severe stress scenario, however,” he warned, “some of the banks’ CET1 (capital) ratios could fall under 9.5 per cent, whereby we believe they might be necessary to take capital conservation measures, cut dividends, or raise additional equity.”

In an interview, Beattie characterized the probability of the severe stress case as “very remote” and said dividend cuts would be avoided through the big banks “except under extreme duress.”

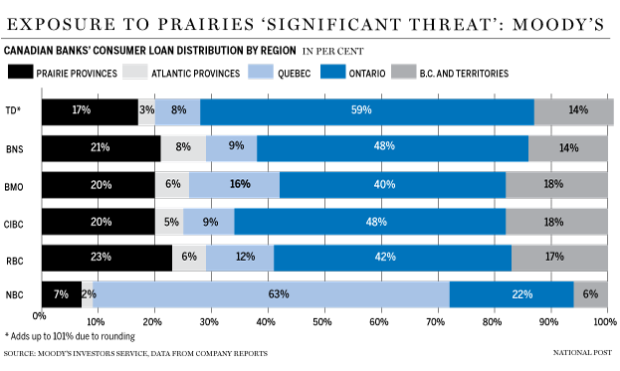

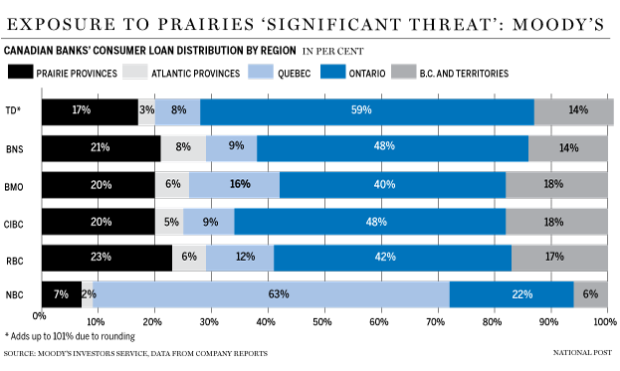

Still, with oil prices slumping to levels not seen in greater than a decade, the ratings agency expects banks will need to absorb the pain of oil producers, drillers, and service companies, in addition to consumers in oil-producing provinces.

In the severe stress test scenario outlined by Moody’s, losses in the big banks’ consumer portfolios would rise over the historical peak, there will be a 20 percent decline in capital markets’ net income, driving losses to at least one.5 times quarterly net income.

In this scenario, unless banks lessen the payout ratio – the percentage of earnings paid to shareholders as dividends – or issued shares, “it would take multiple quarters to soak up stress losses through retained earnings,” Beattie wrote.

Among Canada’s biggest banks, Canadian Imperial Bank of Commerce and Bank of Nova Scotia emerge as the “negative outliers” within the Moody’s stress testing.

CIBC’s rank reflects the fact that the bank’s operations are primarily in Canada. The country’s fifth-largest bank also offers “considerable gas and oil concentration in its corporate loan book, and a material part of its earnings originates from capital markets activities,” Beattie wrote.

Scotiabank would face higher stress losses from its corporate loan book and also the segment mixture of its corporate loans.

In the severe stress scenario, both CIBC and Scotiabank would lose about 100 basis points from CET1, a key measure accustomed to gauge a bank’s capital cushion.

However, Beattie said i am not saying those banks will be the first to have to tap the marketplace for funds with an equity issue, or to reduce dividends.

“Each from the banks is originating from a different starting place when it comes to capital,” he said, adding that all Canada’s big banks hold capital well over the regulatory minimum. What’s more, the banks could invoke capital conservation measures quickly and pre-emptively if the probability of a severe stress situation would begin to rise, he said.

Toronto-Dominion Bank is a “positive outlier” within the Moody’s analysis, losing just 53 basis points of CET1 in the severe stress scenario. Beattie said Canada’s second-largest bank by market capitalization has a relatively small oil and gas corporate loan book, despite that book growing considerably over the past year.

TD also offers a comparatively low concentration of retail operations in oil-producing provinces, and low reliance upon earnings from capital markets, he wrote.

The effect on capital markets activity is tough to predict, Beattie said, adding that underwriting earnings is going to be hurt by reduced equity issues in the energy sector, but that could be a minimum of partly offset by mergers and acquisitions activity that tends to take place throughout a downturn.

bshecter@nationalpost.com

Twitter.com/BatPost

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news