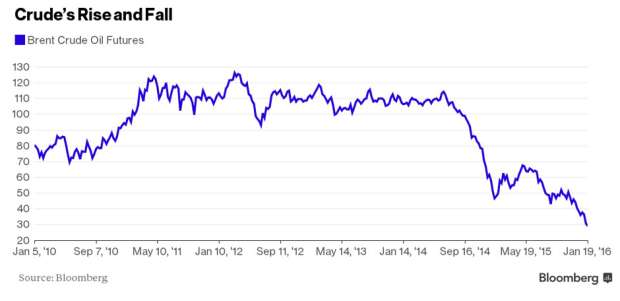

Global oil markets could “drown in oversupply,” sending prices even lower as demand growth slows and Iran revives exports using the end of sanctions, according to the International Energy Agency.

The IEA trimmed 2016 estimates for global oil demand as China’s economic expansion weakens forecasts for supplies away from Organization of Petroleum Exporting Countries. While non-OPEC supply is set to drop 600,000 barrels a day in 2016, Iran’s comeback could fill that gap through the center of the year. As a result, world markets might be playing the surplus of 1.5 million barrels each day in the first half.

“While the pace of stock-building eases in the second half of the year as supply from non-OPEC producers falls, unless something changes, the oil market could drown in oversupply,” said the Paris-based adviser to industrialized economies. Prices “may go lower.”

Oil sank to some 12-year low of under US$28 a barrel in London on Monday as the elimination of international sanctions over the weekend freed Iran to bring back crude exports, threatening to swell a glut developed by fellow OPEC members and U.S. shale drillers. Saudi Arabia, the biggest oil exporter, signaled again on Sunday it won’t relent in its strategy to preserve share of the market even as prices crash.

Iran Growth

Iran could be the only source of supply growth in OPEC this season as a surge in Iraq fizzles out, the IEA said. International sanctions, including those on its oil sector, were lifted on Jan. 16 as Iran met the terms of an agreement to curb its nuclear development program.

The Persian Gulf exporter could add 300,000 barrels each day by the end of the very first quarter and 600,000 barrels a day by the middle of the year, the IEA said. While that’s below official ministry plans to add A million each day by mid-year, it could be enough to pressure prices further, the company predicted. The country pumped at a 3 1/2-year high of 2.91 million barrels each day in December, according to the report.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news