When the European Central Bank meets in March, markets anticipate that it will cut its already negative deposit rate further, deepening Europe’s multi-year test out sub-zero rates of interest, which began in June 2014.

‘Ocean of fear’: Canadian investors located on record cash pile risk billions in lost returns

A new report suggests fearful investors are sitting on an archive $75-billion excessively money in their portfolios, the largest hoard in Canadian history

Read more

The ECB currently charges banks to park cash with it as being a part of a policy where the official deposit rates are set at -0.3 per cent. In a normal interest rate environment, it might be paying banks that leave their cash in its vaults. Three other countries – Denmark Sweden and Switzerland – now flirt with deposit rates as little as -0.5 per cent.

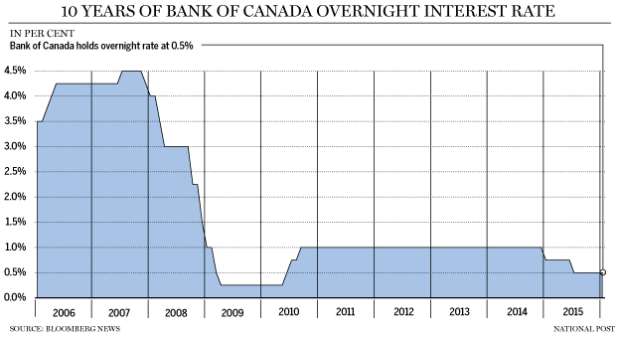

The experiment in Europe is being closely watched around the world, including by policymakers within Canada. Bank of Canada Governor Stephen Poloz discussed negative rates in a luncheon in Toronto last month, using it the radar here. While he asserted addressing negative rates wasn’t any indication the financial institution planned for their services, it nevertheless shows that Poloz and the team are weighing all options because the economy struggles to develop.

Negative minute rates are certainly an anomaly in economic policy. To date, enacting the insurance policy within the eurozone hasn’t led to the type of bizarro scenarios that negative rates can envision – receiving payment to have a mortgage, being charged to leave your money with banks.

Even in the event that the Bank of Canada ever adopts this type of policy – which seems not as likely following this month’s optimism from Poloz – it is unlikely that consumers would see much of a vary from the current rate of interest regime, say experts.

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news