The Organization of Petroleum Exporting Countries has issued its strongest plea up to now for any pact with Russia and other rival producers to chop crude output and halt the collapse in prices.

Forget the glut, even market insiders say oil has entered irrational territory

Oil trading has become detached from fundamentals, experts say, and also the best advice for now is to stay out of the way and wait for the smoke to pay off. Read on

It has also warned the investment slump is storing up serious trouble for the future.

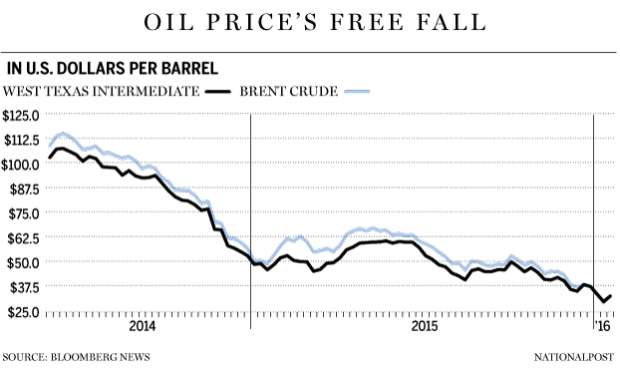

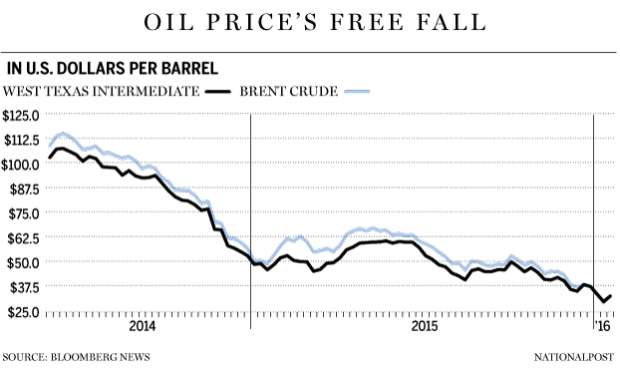

Abdullah al-Badri, OPEC’s secretary-general, said the cartel is ready to embrace rivals and thrash out a compromise following a 72 percent crash in prices since mid-2014.

“Challenging times requires tough choices,” he told a conference at Chatham House in London. “It is vital that all major producers sit down and come track of a solution.”

Al-Badri said the world needs a good investment blitz of US$10 trillion to replace depleting oil fields and to meet extra need for 17 million barrels per day by 2040, yet projects are now being shelved in an alarming rate.

A study by IHS found that investment for the years from 2015 to 2020 has been slashed by $1.8 trillion, when compared with what was planned in 2014.

Al-Badri warned the current glut is setting the stage for a future supply shock, with prices lurching from one extreme to a different inside a deranged market that is within the interests of nobody but speculators. “It is essential that the marketplace addresses the stock overhang,” he explained.

Leonid Fedun, the vice-president of Russia’s oil group Lukoil, separately said OPEC policy had trigger a stampede, comparing it to a “herd of animals rushing to escape a fire. He called around the Kremlin to craft a political cope with the cartel to overcome the glut. “It is best to sell a barrel of oil at US$50 than two barrels at $30,” he told Tass, the Russian news agency.

This is really a shift in policy. It has long been argued that Russian companies cannot join forces with OPEC because the Siberian weather makes it hard to switch output on and off, and listed firms are supposedly answerable to shareholders, not the Kremlin.

Related

Why BMO’s CEO expects it to take 2 or 3 years for oil prices to stabilizeOil’s new mantra: ‘A lot lower for a lot longer’IEA sees world ‘drowning in oil,’ sending crude prices even lower

Mr Fedun said OPEC is going to be instructed to cut output anyway. “This could take place in May or in summer time. Next we will have an immediate recovery,” he explained.

He accused the cartel of incompetence. “When OPEC launched the cost war, they expected U.S. companies to go under very quickly. They discovered that Half of the U.S. production was hedged,” he said.

Mr Fedun said these contracts acted as a subsidy worth $150 million a day though 2015. “With this support shale producers could avoid collapse,” he explained.

The hedges are actually expiring fast, and will cover just 11 per cent of output this season. Iraq’s premier, Haider al-Abadi, was overheard in Davos asking U.S. oil experts exactly once the contracts would run out, an indication of what size this issue now looms in the mind of OPEC leaders.

Mr Fedun said 500 U.S. shale companies face a “meat-grinder” over coming months, leaving 2 or 3 dozen “professionals.”

Claudio Descalzi, head of Italy’s oil group Eni, said OPEC has stopped playing the function of “regulator” for crude, leaving markets within the grip of monetary forces trading “paper barrels” that outnumber actual barrels of oil with a ratio of 80:1.

The paradox of the present slump is the fact that global spare capacity is at wafer-thin levels of two per cent as Saudi Arabia pumps at will, leaving the marketplace acutely susceptible to any future supply-shock. “In the 1980s it was around 30 percent. 10 years ago it was eight percent,” said Mr Descalzi.

Barclays said the capitulation over recent weeks is much like the atmosphere at the begining of 1999, the last time leading analysts said the world was “drowning in oil”. It turned out to be the precise bottom from the cycle. Prices jumped 50per cent over the next 20 days, the start of a 12-year bull market.

Norrish said excess output peaked in the last quarter of 2015 at 2.A million barrels per day (bpd). The over-supply will narrow to at least one.2 million bpd in the first quarter as of this year as a string of OPEC and non-OPEC countries reach “pain points”, despite the return of Iranian crude after the lifting of sanctions. After this season there may be a “small deficit.” At that time the planet will need all OPEC’s 32 million barrels-per-day supply to satisfy growing demand, even though it will require quite a long time to whittle down record stocks.

Norrish said the oil market faces powerful headwinds. U.S. shale has become a swing producer and can crank up output “quite quickly” once prices rebound. Global climate accords have changed the rules from the game and electric vehicles are breaking on to the scene.

Barclays said extreme positioning around the derivatives markets has prepared the floor for any short squeeze: “Unhedged short positions held by speculators are huge so there is certainly the potential for a steep progress in prices sooner or later.”

JP Morgan said the overhang of record short contracts could cause U.S. crude prices to snap back toward US$40 very quickly if sentiment shifts. The atmosphere has already been turning: net inflows into “long oil” eft’s happen to be running at $500 million per week in January.

Saleh Al-Sada, Qatar’s energy minister, said it continues to be too early to the foot of the marketplace. “We’ll go through one more downturn cycle, but we’ll recover. Today’s oil price is not sustainable.”

Finance News Follow us to find the latest Finance news

Finance News Follow us to find the latest Finance news